UM/UIM (UNINSURED/UNDERINSURED MOTORIST) DEMAND LETTER

State of California

[LAW FIRM LETTERHEAD]

PRIVILEGED AND CONFIDENTIAL

SETTLEMENT COMMUNICATION - FOR RESOLUTION PURPOSES ONLY

PROTECTED UNDER CA RULES OF EVIDENCE AND F.R.E. 408

VIA CERTIFIED MAIL, RETURN RECEIPT REQUESTED

AND VIA EMAIL TO: [ADJUSTER_EMAIL]

Date: [DATE]

[INSURANCE_COMPANY_NAME]

[UM_UIM_CLAIMS_DEPARTMENT_ADDRESS]

[CITY], [STATE] [ZIP]

Attention: [ADJUSTER_NAME], [ADJUSTER_TITLE]

Re: UM/UIM POLICY LIMITS DEMAND - CALIFORNIA LAW

Insured/Claimant: [INSURED_CLAIMANT_NAME]

Policy Number: [POLICY_NUMBER]

Claim Number: [CLAIM_NUMBER]

Date of Loss: [DATE_OF_LOSS]

UM/UIM Policy Limits: [UM_UIM_LIMITS]

Tortfeasor: [TORTFEASOR_NAME]

Tortfeasor's Carrier: [TORTFEASOR_CARRIER]

Tortfeasor's Limits: [TORTFEASOR_LIMITS]

Response Deadline: [RESPONSE_DEADLINE]

Dear [ADJUSTER_NAME]:

I. INTRODUCTION AND NATURE OF DEMAND

This firm represents [CLIENT_NAME] ("our client") in connection with a claim for [UNINSURED/UNDERINSURED] motorist benefits under California law arising from a motor vehicle collision on [DATE_OF_LOSS]. This letter constitutes a formal demand for payment of the full UM/UIM policy limits of [UM_UIM_LIMITS].

Our client's damages far exceed the available coverage. Under California law, UM/UIM coverage exists precisely for situations like this - to protect your insured when the negligent party lacks sufficient coverage.

II. CALIFORNIA UM/UIM LAW

A. Stacking Rules in California

Stacking generally permitted. Cal. Ins. Code 11580.2(p)

B. Coverage Analysis Under California Law

| Item | Information |

|---|---|

| Named Insured | [NAMED_INSURED] |

| Policy Number | [POLICY_NUMBER] |

| Policy Period | [POLICY_PERIOD_START] to [POLICY_PERIOD_END] |

| UM Coverage Limit | [UM_LIMIT] per person / [UM_LIMIT_PER_ACCIDENT] per accident |

| UIM Coverage Limit | [UIM_LIMIT] per person / [UIM_LIMIT_PER_ACCIDENT] per accident |

| Stacking Status | [STACKED/NON-STACKED] |

| Vehicles on Policy | [NUMBER_OF_VEHICLES] |

C. Coverage Trigger

For Uninsured Motorist (UM) Claims:

The tortfeasor qualifies as an "uninsured motorist" under California law because:

- The tortfeasor had no liability insurance at the time of the collision

- The tortfeasor's insurer has denied coverage

- The tortfeasor's insurer is insolvent

- The tortfeasor was a hit-and-run driver who cannot be identified

- The tortfeasor's insurance limits are less than state minimum requirements

For Underinsured Motorist (UIM) Claims:

The tortfeasor qualifies as an "underinsured motorist" under California law because:

- The tortfeasor's liability limits of [TORTFEASOR_LIMITS] are insufficient to compensate our client

- Our client has exhausted/will exhaust the tortfeasor's policy limits

- Our client's damages exceed the available coverage

III. THE COLLISION AND LIABILITY

A. Facts of the Collision

On [DATE_OF_LOSS], at approximately [TIME], our client was [DESCRIBE_CLIENT_ACTIVITY] at or near [LOCATION_OF_COLLISION] in California.

[DETAILED_DESCRIPTION_OF_COLLISION]

B. Tortfeasor's Negligence

The tortfeasor, [TORTFEASOR_NAME], was negligent under California law in the following respects:

- Failure to maintain proper lookout

- Failure to yield right-of-way

- Following too closely

- Excessive speed for conditions

- Distracted driving

- Running red light/stop sign

- Improper lane change

- Driving under the influence

- [OTHER_NEGLIGENCE]

C. Evidence of Liability

The following evidence establishes liability:

1. Police Report

[POLICE_DEPARTMENT] Traffic Crash Report (Report No. [REPORT_NUMBER])

2. Witness Statements

[NUMBER] independent witnesses observed the collision

3. Physical Evidence

Point of impact, vehicle damage patterns, and debris field analysis

4. Expert Analysis (if applicable)

[ACCIDENT_RECONSTRUCTIONIST_NAME] has concluded [SUMMARY_OF_OPINION]

D. Our Client's Freedom from Comparative Fault

Under California law, our client bears no comparative fault for this collision.

IV. OUR CLIENT'S INJURIES AND TREATMENT

A. Injury Summary

As a direct and proximate result of this collision, our client sustained:

Primary Injuries:

- [PRIMARY_INJURY_1]

- [PRIMARY_INJURY_2]

- [PRIMARY_INJURY_3]

B. Treatment Timeline

| Provider | Specialty | Treatment Dates | Treatment Provided |

|---|---|---|---|

| [PROVIDER_1] | [SPECIALTY_1] | [DATES_1] | [TREATMENT_1] |

| [PROVIDER_2] | [SPECIALTY_2] | [DATES_2] | [TREATMENT_2] |

| [PROVIDER_3] | [SPECIALTY_3] | [DATES_3] | [TREATMENT_3] |

C. Current Condition and Prognosis

[DESCRIBE_CURRENT_CONDITION_AND_PROGNOSIS]

D. Permanent Impairment

| Body Part/System | Impairment Rating |

|---|---|

| [BODY_PART_1] | [RATING_1]% |

| [BODY_PART_2] | [RATING_2]% |

| Combined Whole Person | [COMBINED]% |

V. DAMAGES

A. Medical Expenses

Past Medical Expenses:

| Provider | Dates of Service | Charges |

|---|---|---|

| [PROVIDER_1] | [DATES_1] | $[AMOUNT_1] |

| [PROVIDER_2] | [DATES_2] | $[AMOUNT_2] |

| [PROVIDER_3] | [DATES_3] | $[AMOUNT_3] |

| TOTAL PAST MEDICAL | $[TOTAL_PAST_MEDICAL] |

Future Medical Expenses (Present Value):

| Treatment/Service | Estimated Cost |

|---|---|

| [TREATMENT_1] | $[COST_1] |

| [TREATMENT_2] | $[COST_2] |

| TOTAL FUTURE MEDICAL | $[TOTAL_FUTURE_MEDICAL] |

B. Lost Income

Past Lost Income:

$[TOTAL_PAST_LOST_INCOME]

Future Lost Earning Capacity:

$[FUTURE_LOST_EARNING_CAPACITY] (Present Value)

C. Pain and Suffering / Non-Economic Damages

[DESCRIBE_PAIN_AND_SUFFERING]

D. Damages Summary

| Category | Amount |

|---|---|

| Past Medical Expenses | $[PAST_MEDICAL] |

| Future Medical Expenses | $[FUTURE_MEDICAL] |

| Past Lost Income | $[PAST_LOST_INCOME] |

| Future Lost Earning Capacity | $[FUTURE_EARNING_CAPACITY] |

| Pain and Suffering | $[PAIN_SUFFERING] |

| TOTAL DAMAGES | $[TOTAL_DAMAGES] |

VI. SETTLEMENT WITH TORTFEASOR'S INSURER

A. Settlement Status

We [HAVE REACHED/ARE PURSUING] a settlement with the tortfeasor's liability carrier, [TORTFEASOR_CARRIER], for the tortfeasor's policy limits of $[TORTFEASOR_LIMITS].

B. Consent to Settle / Preservation of Subrogation Rights

IMPORTANT: Pursuant to California law and policy terms, we hereby request consent to settle with the tortfeasor's carrier.

Please provide written consent within [NUMBER] days.

VII. DEMAND FOR UM/UIM BENEFITS

A. Calculation of UIM Benefits Due

| Item | Amount |

|---|---|

| Total Damages | $[TOTAL_DAMAGES] |

| Less: Tortfeasor's Limits | ($[TORTFEASOR_LIMITS]) |

| Underinsured Damages | $[UNDERINSURED_DAMAGES] |

| Available UIM Limits | $[UIM_LIMITS] |

| UIM BENEFITS DEMANDED | $[UIM_DEMAND] |

B. Policy Limits Demand

We hereby demand payment of the full UM/UIM policy limits of $[UM_UIM_LIMITS].

Our client's damages of $[TOTAL_DAMAGES] vastly exceed the combined coverage available. This is a clear policy limits case under California law.

VIII. BAD FAITH WARNING

[CARRIER_SHORT_NAME] owes our client, its own insured, the duties of good faith and fair dealing recognized under California law.

California Bad Faith Standard:

California recognizes both tort and contract theories for bad faith. The implied covenant of good faith and fair dealing requires insurers to not unreasonably withhold policy benefits. Insurer acts in bad faith when it unreasonably withholds benefits. Gruenberg v. Aetna Ins. Co., 9 Cal.3d 566 (1973). Even genuine dispute does not shield insurer if position is unreasonable.

Available Remedies for Bad Faith:

Policy benefits, consequential damages, emotional distress, Brandt fees (attorney fees to obtain benefits), and punitive damages

Any attempt to deny, delay, or lowball this claim will be met with a bad faith action.

IX. ARBITRATION CONSIDERATIONS

A. Policy Arbitration Clause

The policy [CONTAINS/DOES_NOT_CONTAIN] an arbitration clause for UM/UIM disputes under California law.

[IF APPLICABLE: Quote arbitration clause and state procedural requirements]

B. Arbitration Demand (If Applicable)

If [CARRIER_SHORT_NAME] fails to accept this demand, consider this letter as notice of our intent to invoke arbitration under California law.

X. RESPONSE DEADLINE

This demand expires at 5:00 p.m. [TIME_ZONE] on [RESPONSE_DEADLINE].

Consequences of Non-Response

If [CARRIER_SHORT_NAME] fails to accept this demand:

- We will invoke arbitration (if required) or file suit in California

- We will pursue bad faith damages under California law

- We will file a complaint with California Department of Insurance, 300 Capitol Mall, Suite 1700, Sacramento, CA 95814

XI. CONCLUSION

This claim presents clear liability, severe injuries, and damages far exceeding coverage. [CARRIER_SHORT_NAME] has an opportunity to resolve this matter fairly by paying the policy limits to its own insured under California law.

Respectfully submitted,

[LAW_FIRM_NAME]

By: _______________________________

[ATTORNEY_NAME]

[BAR_NUMBER]

[ADDRESS]

[CITY], CA [ZIP]

[PHONE]

[EMAIL]

Counsel for [CLIENT_NAME]

ENCLOSURES:

- Policy declarations page

- UM/UIM coverage provisions

- Police report

- Medical records and bills

- Photographs

- Expert reports (if applicable)

CC:

- [CLIENT_NAME]

- [TORTFEASOR_CARRIER] (re: consent to settle)

CALIFORNIA UM/UIM LAW QUICK REFERENCE

| Element | California Law |

|---|---|

| Stacking Rules | Stacking generally permitted. Cal. Ins. Code 11580.2(p) |

| Bad Faith Type | Common Law and Statutory |

| Bad Faith Damages | Policy benefits, consequential damages, emotional distress, Brandt fees (attorney fees to obtain benefits), and punitive damages |

| Attorney Fees | Brandt fees recoverable as element of tort damages. Brandt v. Superior Court, 37 Cal.3d 813 (1985) |

| DOI Address | California Department of Insurance, 300 Capitol Mall, Suite 1700, Sacramento, CA 95814 |

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

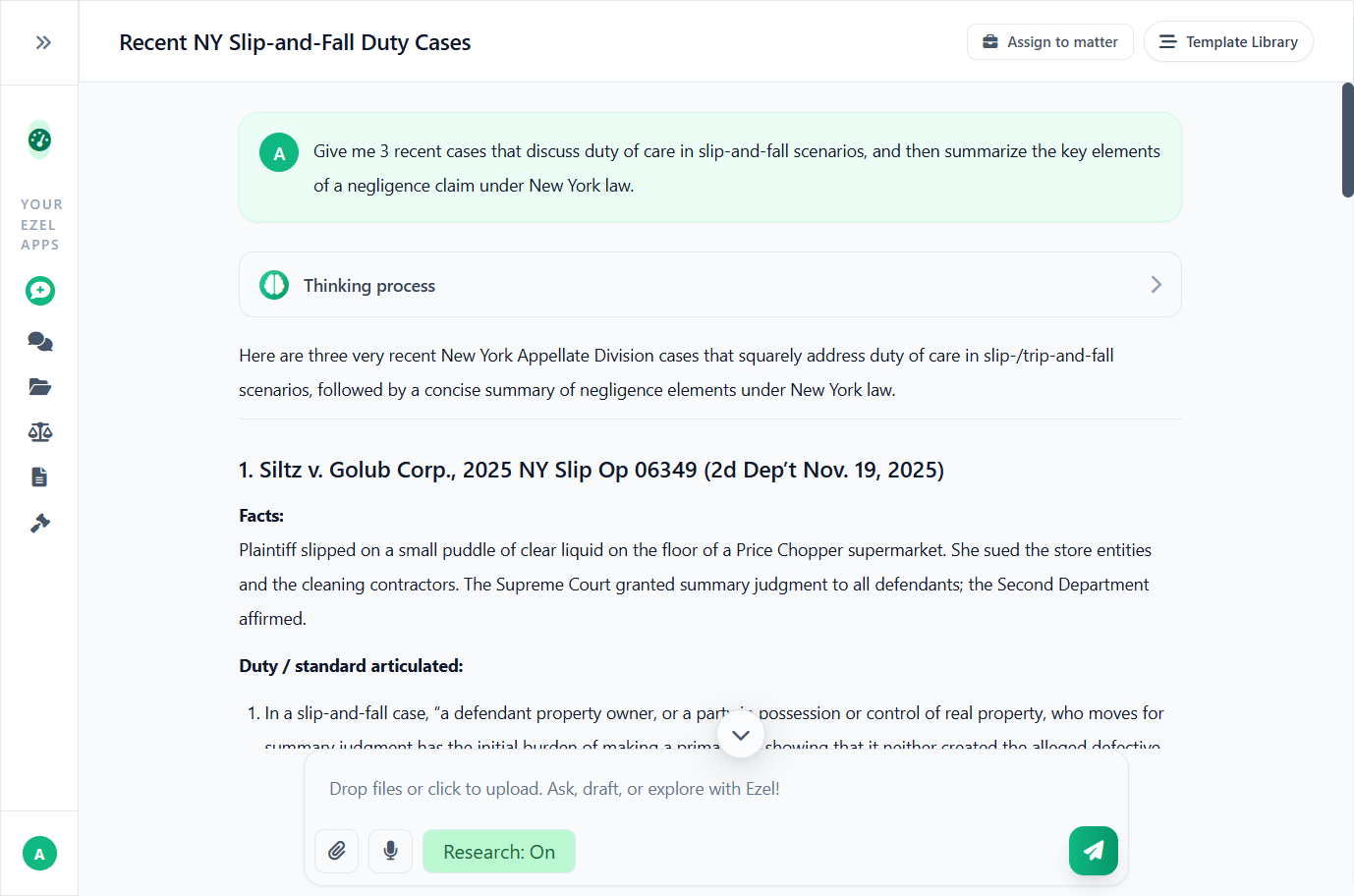

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

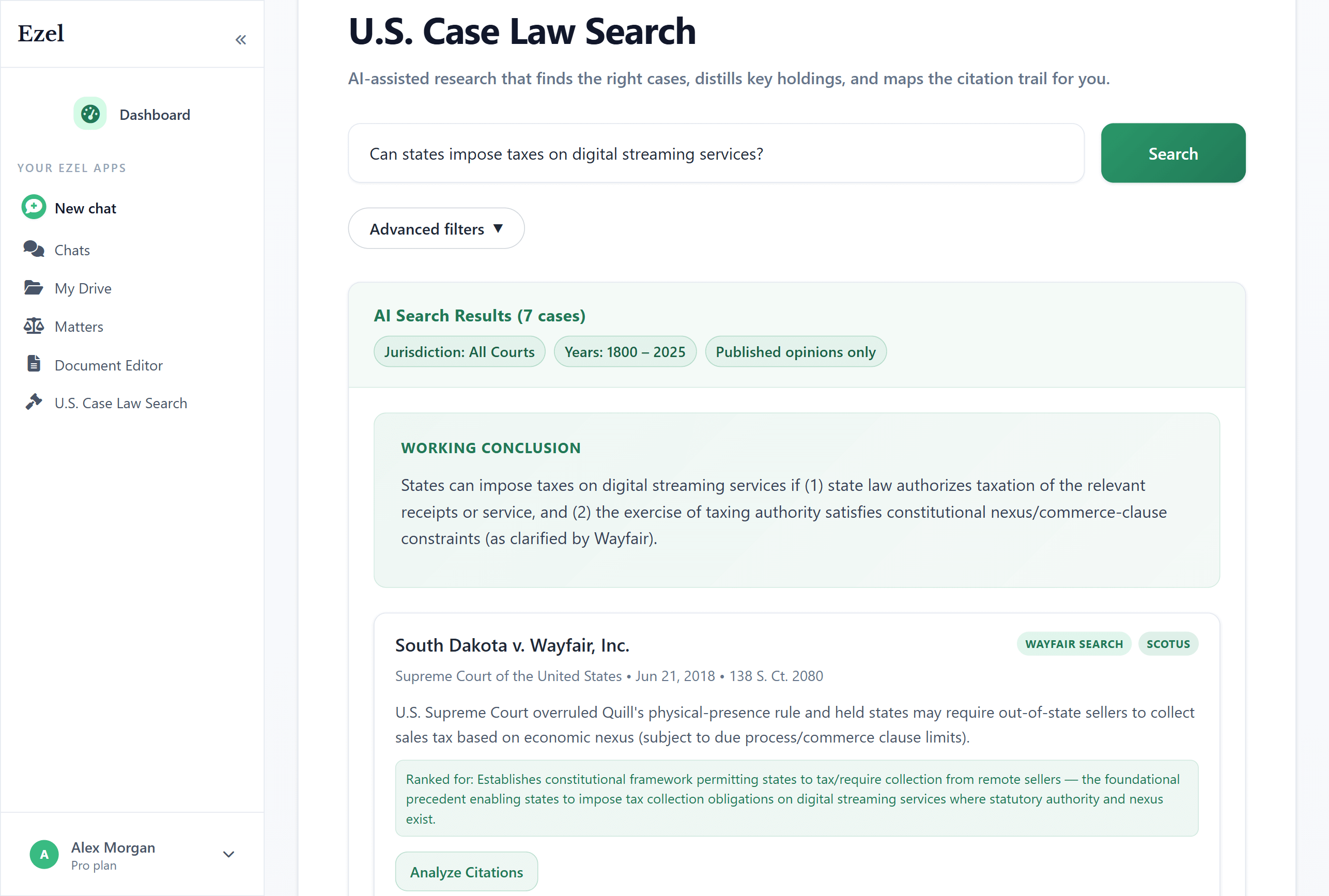

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.