INSURANCE BAD FAITH DEMAND LETTER

State of Texas

[LAW FIRM LETTERHEAD]

PRIVILEGED AND CONFIDENTIAL

SETTLEMENT COMMUNICATION - FOR RESOLUTION PURPOSES ONLY

PROTECTED UNDER TX RULES OF EVIDENCE AND F.R.E. 408

VIA CERTIFIED MAIL, RETURN RECEIPT REQUESTED

AND VIA EMAIL TO: [ADJUSTER_EMAIL]

Date: [DATE]

[INSURANCE_COMPANY_NAME]

[CLAIMS_DEPARTMENT_ADDRESS]

[CITY], [STATE] [ZIP]

Attention: [ADJUSTER_NAME], [ADJUSTER_TITLE]

Re: FORMAL BAD FAITH DEMAND - TEXAS LAW

Insured: [INSURED_NAME]

Claimant: [CLAIMANT_NAME]

Policy Number: [POLICY_NUMBER]

Claim Number: [CLAIM_NUMBER]

Date of Loss: [DATE_OF_LOSS]

Policy Limits: [POLICY_LIMITS]

Response Deadline: [RESPONSE_DEADLINE] (This is a Time-Limited Demand)

Dear [ADJUSTER_NAME]:

I. INTRODUCTION AND NATURE OF DEMAND

This firm represents [CLIENT_NAME] ("our client") in connection with the above-referenced insurance claim arising under the laws of Texas. This letter constitutes a formal demand for payment of policy benefits wrongfully withheld and serves as notice of [INSURANCE_COMPANY_NAME]'s ("the Company" or "[CARRIER_SHORT_NAME]") bad faith conduct in handling our client's claim under Texas law.

As a seasoned insurance litigator with decades of experience representing policyholders against major carriers in Texas, I am well aware of the Company's obligations under Tex. Ins. Code and Texas common law. The Company's conduct in this matter constitutes a textbook example of bad faith claims practices that Texas courts routinely punish with substantial damages.

This is a time-limited demand. The Company has until [RESPONSE_DEADLINE] to tender the full amount owed of $[DEMAND_AMOUNT] and resolve all claims arising from this loss. Failure to do so will result in immediate litigation seeking all available remedies under Texas law.

II. TEXAS BAD FAITH LAW

A. Legal Standard

Texas provides remedies under Insurance Code Chapter 541 (unfair practices) and common law bad faith. First-party bad faith requires showing insurer had no reasonable basis to deny/delay claim and knew or should have known. USAA v. Menchaca, 545 S.W.3d 479 (Tex. 2018). Prompt Payment Act (Chapter 542) provides 18% interest penalty.

B. Available Damages Under Texas Law

Under Texas law, our client is entitled to recover:

Actual damages under Chapter 541, 18% penalty interest under Chapter 542, treble damages (up to 3x actual), and attorney fees

C. Punitive Damages Standard

Actual fraud, malice, or gross negligence (clear and convincing)

D. Attorney's Fees

Recoverable under Tex. Ins. Code 541.152 and 542.060

III. POLICY INFORMATION AND COVERAGE

A. Policy Details

| Item | Information |

|---|---|

| Named Insured | [INSURED_NAME] |

| Policy Number | [POLICY_NUMBER] |

| Policy Period | [POLICY_PERIOD_START] to [POLICY_PERIOD_END] |

| Policy Type | [POLICY_TYPE] |

| Applicable Coverage | [COVERAGE_TYPE] |

| Per-Occurrence Limit | [PER_OCCURRENCE_LIMIT] |

| Aggregate Limit | [AGGREGATE_LIMIT] |

| Deductible | [DEDUCTIBLE_AMOUNT] |

B. Coverage Analysis

The policy provides coverage for [DESCRIBE_COVERED_LOSS_TYPE]. The loss clearly falls within the policy's insuring agreement under Texas law interpretation principles.

[CARRIER_SHORT_NAME] has acknowledged coverage by [DESCRIBE_COVERAGE_ACKNOWLEDGMENT]. Having accepted coverage, the Company is obligated under Texas law to:

- Conduct a thorough, fair, and objective investigation

- Evaluate the claim in good faith

- Promptly pay all amounts owed under the policy

- Communicate honestly and transparently with the insured

- Avoid unreasonable delays in claim handling

- Refrain from compelling litigation through unreasonable conduct

IV. FACTUAL BACKGROUND AND CLAIM HISTORY

A. The Underlying Loss

On [DATE_OF_LOSS], [DESCRIBE_LOSS_EVENT_IN_DETAIL].

[ADDITIONAL_LOSS_DETAILS]

B. Chronological Timeline of Bad Faith Conduct

| Date | Event | Bad Faith Indicator |

|---|---|---|

| [DATE_1] | [EVENT_1] | [INDICATOR_1] |

| [DATE_2] | [EVENT_2] | [INDICATOR_2] |

| [DATE_3] | [EVENT_3] | [INDICATOR_3] |

| [DATE_4] | [EVENT_4] | [INDICATOR_4] |

| [DATE_5] | [EVENT_5] | [INDICATOR_5] |

| [DATE_6] | [EVENT_6] | [INDICATOR_6] |

V. SPECIFIC BAD FAITH CONDUCT

[CARRIER_SHORT_NAME]'s handling of this claim violates both the express and implied covenants of good faith and fair dealing recognized under Texas law:

A. Unreasonable Delay

The Company has unreasonably delayed the investigation, evaluation, and payment of this claim in violation of Texas law:

- [DESCRIBE_SPECIFIC_DELAY_1]

- [DESCRIBE_SPECIFIC_DELAY_2]

- [DESCRIBE_SPECIFIC_DELAY_3]

B. Inadequate Investigation

[CARRIER_SHORT_NAME] failed to conduct the thorough, fair, and objective investigation required under Texas law:

- [INVESTIGATION_FAILURE_1]

- [INVESTIGATION_FAILURE_2]

- [INVESTIGATION_FAILURE_3]

C. Unreasonable Settlement Offers

The Company's settlement offers have been grossly inadequate:

| Date | Offer Amount | Actual Value | Discrepancy |

|---|---|---|---|

| [DATE_A] | [OFFER_A] | [VALUE_A] | [DISCREPANCY_A] |

| [DATE_B] | [OFFER_B] | [VALUE_B] | [DISCREPANCY_B] |

D. Misrepresentation of Policy Provisions

[DESCRIBE_MISREPRESENTATIONS]

E. Failure to Communicate

[DESCRIBE_COMMUNICATION_FAILURES]

VI. STATUTORY VIOLATIONS

A. Texas Unfair Claims Settlement Practices Act

[CARRIER_SHORT_NAME]'s conduct violates Tex. Ins. Code Chapter 541, which prohibits:

- Misrepresenting pertinent facts or insurance policy provisions relating to coverages at issue

- Failing to acknowledge and act reasonably promptly upon communications with respect to claims

- Failing to adopt and implement reasonable standards for the prompt investigation of claims

- Refusing to pay claims without conducting a reasonable investigation

- Not attempting in good faith to effectuate prompt, fair, and equitable settlements of claims in which liability has become reasonably clear

- Compelling insureds to institute litigation to recover amounts due under an insurance policy by offering substantially less than the amounts ultimately recovered

- Attempting to settle a claim for less than the amount to which a reasonable person would have believed he or she was entitled

- Failing to promptly provide a reasonable explanation of the basis in the policy for denial or inadequate offer

B. Texas Prompt Payment Requirements

[CARRIER_SHORT_NAME] has violated Tex. Ins. Code Chapter 542 - 15 days to acknowledge, 60 days to accept/reject, 5 business days to pay after acceptance; 18% interest penalty by:

- [SPECIFIC_PROMPT_PAYMENT_VIOLATION_1]

- [SPECIFIC_PROMPT_PAYMENT_VIOLATION_2]

- [SPECIFIC_PROMPT_PAYMENT_VIOLATION_3]

VII. DAMAGES

A. Contract Damages

| Category | Amount |

|---|---|

| Policy Benefits Owed | $[AMOUNT] |

| Less Amounts Paid | ($[AMOUNT_PAID]) |

| Net Policy Benefits Due | $[NET_AMOUNT] |

B. Consequential Damages

| Category | Amount |

|---|---|

| [CONSEQUENTIAL_CATEGORY_1] | $[AMOUNT_1] |

| [CONSEQUENTIAL_CATEGORY_2] | $[AMOUNT_2] |

| [CONSEQUENTIAL_CATEGORY_3] | $[AMOUNT_3] |

| Total Consequential Damages | $[TOTAL_CONSEQUENTIAL] |

C. Emotional Distress Damages

[DESCRIBE_EMOTIONAL_DISTRESS_IF_RECOVERABLE_UNDER_TX_LAW]

D. Punitive/Exemplary Damages

Under Texas law, punitive damages require: Actual fraud, malice, or gross negligence (clear and convincing)

The Company's conduct meets this standard because [DESCRIBE_AGGRAVATING_FACTORS].

E. Statutory Penalties

Under Texas law, our client is entitled to:

[STATE_SPECIFIC_STATUTORY_PENALTIES]

VIII. DEMAND

Based on the foregoing, we hereby demand that [CARRIER_SHORT_NAME]:

A. Monetary Demand

Pay the total sum of $[TOTAL_DEMAND_AMOUNT] as follows:

| Component | Amount |

|---|---|

| Policy Benefits | $[POLICY_BENEFITS] |

| Statutory Interest/Penalties | $[STATUTORY_INTEREST] |

| Consequential Damages | $[CONSEQUENTIAL_DAMAGES] |

| TOTAL DEMAND | $[TOTAL_DEMAND_AMOUNT] |

B. Settlement Terms

In addition to the monetary payment:

- Full and complete release of all claims by [CARRIER_SHORT_NAME] against our client

- Confidentiality agreement regarding settlement terms (optional)

- Correction of any adverse information reported to industry databases

IX. TIME-LIMITED NATURE OF THIS DEMAND

THIS DEMAND EXPIRES AT 5:00 P.M. [TIME_ZONE] ON [RESPONSE_DEADLINE].

Special Note: Stowers Doctrine - requires insurer to accept reasonable settlement demand within policy limits. G.A. Stowers Furniture Co. v. Am. Indem. Co., 15 S.W.2d 544 (Tex. 1929). Must offer full release, within limits, with reasonable time to respond.

Consequences of Non-Response

If [CARRIER_SHORT_NAME] fails to accept this demand by the deadline:

-

Litigation will be filed immediately in Texas seeking all available remedies

-

This demand will be withdrawn and our client will seek:

- Full policy benefits plus prejudgment interest

- All consequential and emotional distress damages

- Punitive damages without limitation

- Attorney's fees and costs

- All statutory penalties under Texas law -

Regulatory complaints will be filed with:

- Texas Department of Insurance, P.O. Box 149104, Austin, TX 78714

- National Association of Insurance Commissioners

X. DOCUMENT PRESERVATION NOTICE

This letter constitutes formal notice to preserve all documents and electronically stored information related to this claim, including but not limited to:

- The complete claim file, including all versions and drafts

- All internal communications regarding this claim

- All communications with the insured/claimant

- Adjuster notes, diaries, and activity logs

- All documents received from or sent to the insured/claimant

- All photographs, videos, and inspection reports

- All expert reports, estimates, and evaluations

- Claim handling guidelines, manuals, and procedures

- Training materials relevant to this type of claim

- Reserve information and reserve change documentation

- Supervisor notes and approvals

- Quality assurance or audit reports

XI. CONCLUSION

[CARRIER_SHORT_NAME]'s handling of this claim represents precisely the type of conduct that Texas bad faith laws were enacted to prevent and punish. We strongly encourage the Company to use this opportunity to resolve this matter fairly under Texas law.

Please direct all communications regarding this matter to the undersigned.

Respectfully submitted,

[LAW_FIRM_NAME]

By: _______________________________

[ATTORNEY_NAME]

[BAR_NUMBER]

[ADDRESS]

[CITY], TX [ZIP]

[PHONE]

[FAX]

[EMAIL]

Counsel for [CLIENT_NAME]

ENCLOSURES:

- Policy declarations page

- Relevant policy provisions

- Claim correspondence chronology

- Damage documentation

- Expert reports (if applicable)

CC:

- [CLIENT_NAME]

- Texas Department of Insurance, P.O. Box 149104, Austin, TX 78714 (via complaint filing)

TEXAS LAW QUICK REFERENCE

| Element | Texas Law |

|---|---|

| Bad Faith Type | Statutory and Common Law |

| Governing Statute | Tex. Ins. Code |

| Unfair Practices Act | Tex. Ins. Code Chapter 541 |

| Prompt Payment | Tex. Ins. Code Chapter 542 - 15 days to acknowledge, 60 days to accept/reject, 5 business days to pay after acceptance; 18% interest penalty |

| Punitive Standard | Actual fraud, malice, or gross negligence (clear and convincing) |

| Attorney Fees | Recoverable under Tex. Ins. Code 541.152 and 542.060 |

| DOI Address | Texas Department of Insurance, P.O. Box 149104, Austin, TX 78714 |

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

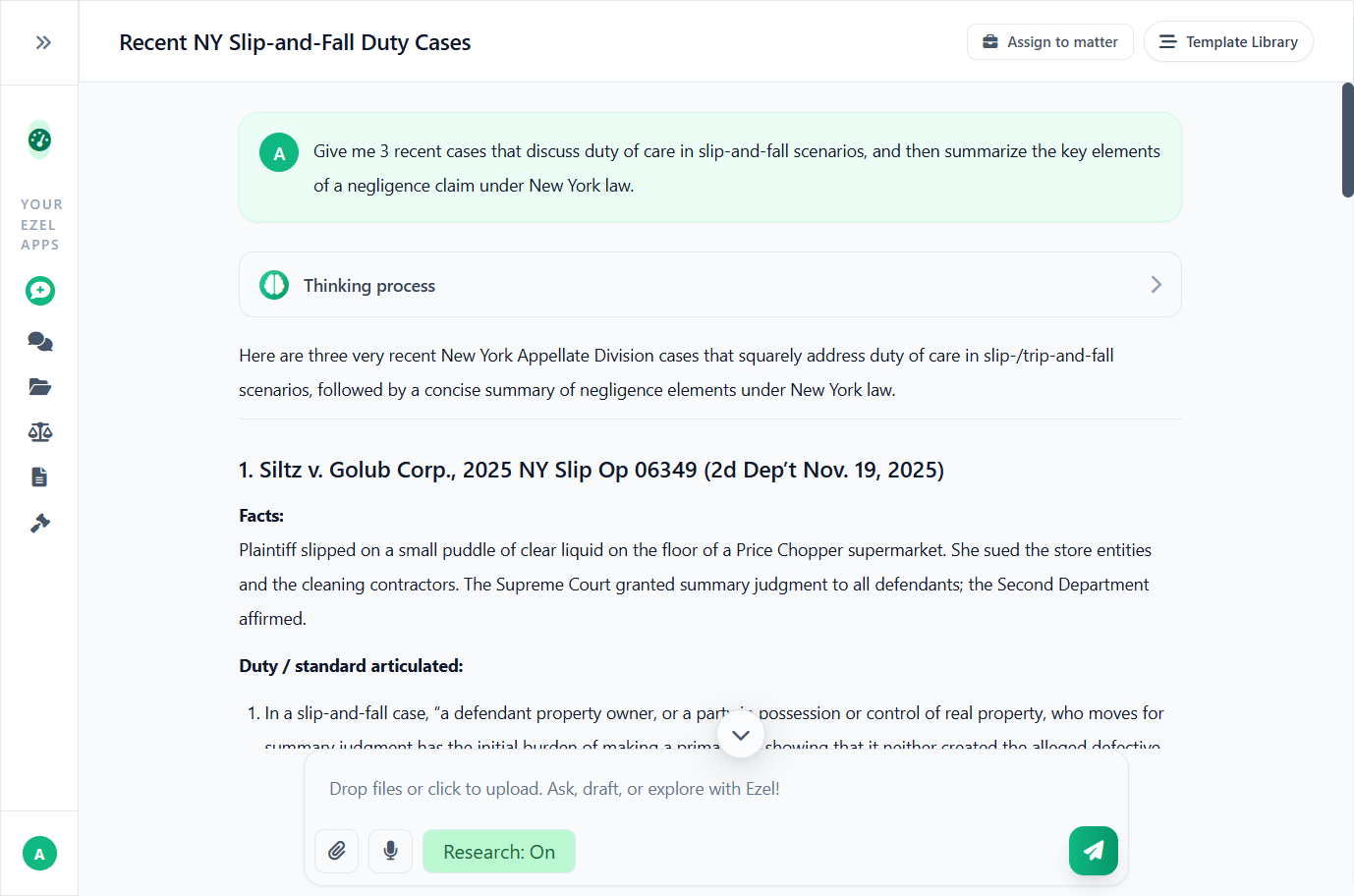

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

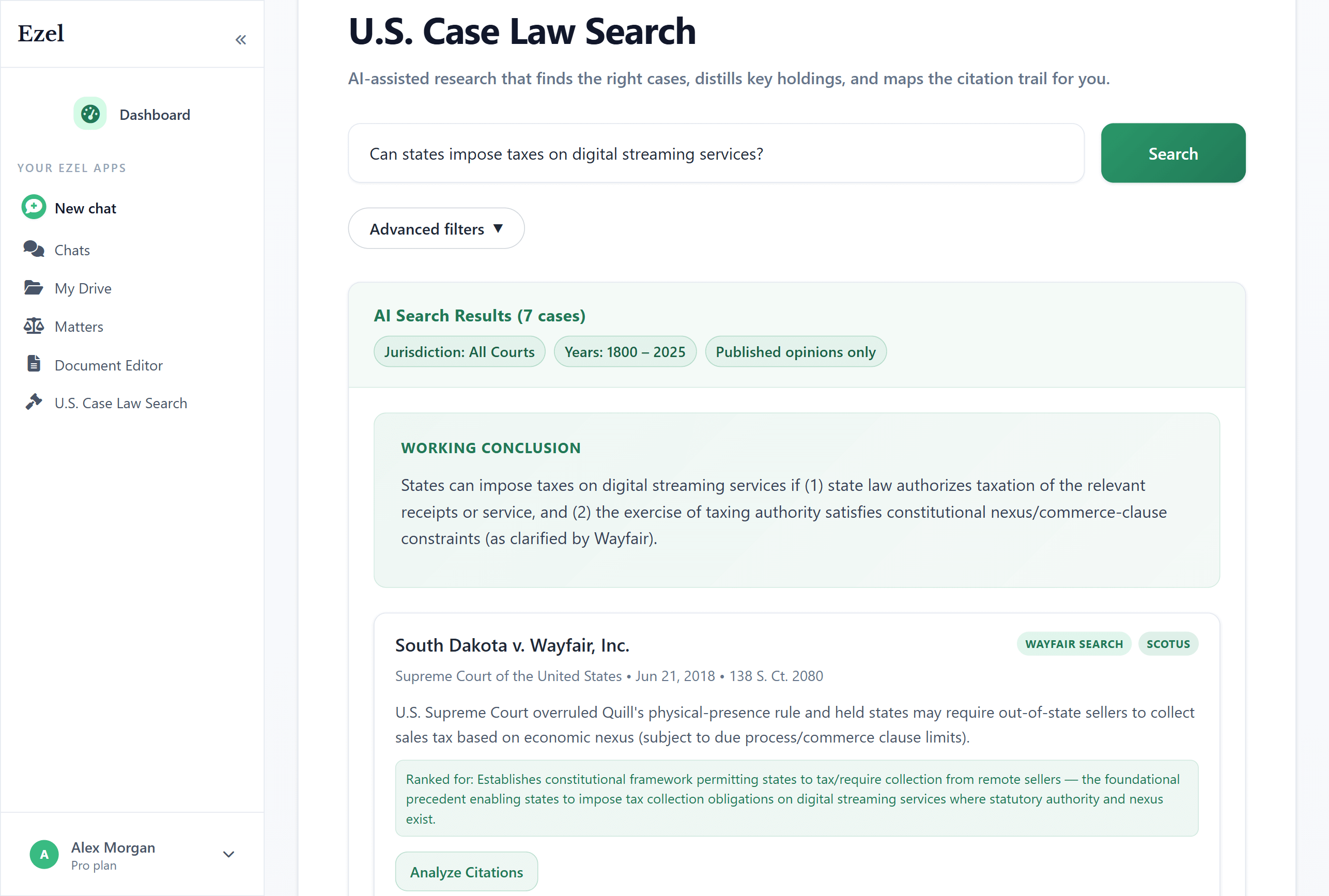

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.