FIRST-PARTY PROPERTY DAMAGE DEMAND LETTER

State of Florida

[LAW FIRM LETTERHEAD]

PRIVILEGED AND CONFIDENTIAL

SETTLEMENT COMMUNICATION - FOR RESOLUTION PURPOSES ONLY

PROTECTED UNDER FL RULES OF EVIDENCE AND F.R.E. 408

VIA CERTIFIED MAIL, RETURN RECEIPT REQUESTED

AND VIA EMAIL TO: [ADJUSTER_EMAIL]

Date: [DATE]

[INSURANCE_COMPANY_NAME]

[PROPERTY_CLAIMS_DEPARTMENT_ADDRESS]

[CITY], [STATE] [ZIP]

Attention: [ADJUSTER_NAME], [ADJUSTER_TITLE]

Re: FORMAL DEMAND FOR PROPERTY DAMAGE CLAIM - FLORIDA LAW

Insured: [INSURED_NAME]

Property Address: [PROPERTY_ADDRESS]

Policy Number: [POLICY_NUMBER]

Claim Number: [CLAIM_NUMBER]

Date of Loss: [DATE_OF_LOSS]

Type of Loss: [LOSS_TYPE]

Coverage Limits: [COVERAGE_LIMITS]

Response Deadline: [RESPONSE_DEADLINE]

Dear [ADJUSTER_NAME]:

I. INTRODUCTION AND NATURE OF DEMAND

This firm represents [CLIENT_NAME] ("our client") in connection with the above-referenced property damage insurance claim arising under Florida law. This letter constitutes a formal demand for payment of all policy benefits owed for covered losses sustained at [PROPERTY_ADDRESS].

Having represented policyholders in Florida for decades, the pattern in this case is all too familiar: a legitimate claim, a covered loss, and an insurer that has [DELAYED PAYMENT/UNDERVALUED THE LOSS/DENIED COVERAGE WITHOUT JUSTIFICATION].

II. FLORIDA PROPERTY INSURANCE LAW

A. Prompt Payment Requirements

Under Florida law:

Fla. Stat. 627.70131 - 90 days to pay or deny claim; 10% penalty interest

B. Appraisal Provisions

Fla. Stat. 627.7015 - Residential property appraisal requirements

C. Bad Faith Standard

Florida recognizes both statutory (Fla. Stat. 624.155) and common law bad faith. As of HB 837 (2023), claimants must show more than negligence - insurer must have acted with intentional misconduct or reckless disregard. 90-day safe harbor for liability claims. Conduct of all parties considered. Civil Remedy Notice (CRN) required before suit.

D. Available Remedies

Damages in excess of policy limits, consequential damages, emotional distress, punitive damages, and attorney fees

III. POLICY INFORMATION AND COVERAGE

A. Policy Details

| Item | Information |

|---|---|

| Named Insured | [INSURED_NAME] |

| Policy Number | [POLICY_NUMBER] |

| Policy Type | [POLICY_TYPE] |

| Policy Period | [POLICY_PERIOD_START] to [POLICY_PERIOD_END] |

| Property Address | [PROPERTY_ADDRESS] |

| Property Type | [PROPERTY_TYPE] |

B. Applicable Coverage and Limits

| Coverage | Limit | Deductible |

|---|---|---|

| Dwelling (Coverage A) | $[DWELLING_LIMIT] | $[DEDUCTIBLE] |

| Other Structures (Coverage B) | $[OTHER_STRUCTURES_LIMIT] | |

| Personal Property (Coverage C) | $[PERSONAL_PROPERTY_LIMIT] | |

| Loss of Use (Coverage D) | $[LOSS_OF_USE_LIMIT] |

C. Coverage Analysis

The loss is clearly covered under Florida law interpretation principles because:

- The cause of loss is a covered peril

- The damage occurred during the policy period

- The property is covered property

- No exclusions apply

- All policy conditions have been satisfied

IV. THE LOSS EVENT

A. Description of Loss

On [DATE_OF_LOSS], the insured property at [PROPERTY_ADDRESS] sustained significant damage due to [DESCRIBE_LOSS_EVENT].

[DETAILED_NARRATIVE]

B. Cause and Origin

The cause of the loss was:

- Fire (accidental/electrical/HVAC/other)

- Water damage (plumbing/appliance/roof/storm)

- Wind/Windstorm

- Hail

- Hurricane/Named Storm

- Tornado

- Lightning

- Theft/Vandalism

- [OTHER_CAUSE]

C. Mitigation Efforts

Our client took immediate steps to mitigate damage as required under Florida law:

| Date | Action | Provider | Cost |

|---|---|---|---|

| [DATE_1] | [ACTION_1] | [PROVIDER_1] | $[COST_1] |

| [DATE_2] | [ACTION_2] | [PROVIDER_2] | $[COST_2] |

V. CLAIM HISTORY AND INSURER'S RESPONSE

A. Claim Timeline

| Date | Event |

|---|---|

| [DATE_OF_LOSS] | Date of loss |

| [CLAIM_REPORT_DATE] | Loss reported |

| [INSPECTION_DATE] | Property inspected |

| [ESTIMATE_DATE] | Estimate issued |

| [PAYMENT_DATE] | Payment issued: $[INITIAL_PAYMENT] |

B. Insurer's Position and Our Response

[CARRIER_SHORT_NAME] has [DESCRIBE_INSURER_POSITION].

This position is unreasonable under Florida law because [EXPLAIN_WHY_WRONG].

VI. DAMAGES AND CLAIMED AMOUNTS

A. Dwelling Damage (Coverage A)

| Category | Amount |

|---|---|

| Structural Damage | $[STRUCTURAL] |

| Systems (Electrical/Plumbing/HVAC) | $[SYSTEMS] |

| Interior Finishes | $[INTERIOR] |

| Overhead & Profit | $[O_AND_P] |

| TOTAL DWELLING | $[TOTAL_DWELLING] |

B. Other Structures (Coverage B)

$[TOTAL_OTHER_STRUCTURES]

C. Personal Property (Coverage C)

| Category | Replacement Cost |

|---|---|

| Furniture | $[FURNITURE] |

| Electronics | $[ELECTRONICS] |

| Appliances | $[APPLIANCES] |

| Clothing | $[CLOTHING] |

| Other | $[OTHER] |

| TOTAL | $[TOTAL_PP] |

D. Loss of Use (Coverage D)

| Category | Amount |

|---|---|

| Temporary Housing | $[HOUSING] |

| Increased Expenses | $[EXPENSES] |

| TOTAL | $[TOTAL_ALE] |

E. Claim Summary

| Coverage | Claimed | Paid | Balance Due |

|---|---|---|---|

| Coverage A | $[A_CLAIMED] | $[A_PAID] | $[A_DUE] |

| Coverage B | $[B_CLAIMED] | $[B_PAID] | $[B_DUE] |

| Coverage C | $[C_CLAIMED] | $[C_PAID] | $[C_DUE] |

| Coverage D | $[D_CLAIMED] | $[D_PAID] | $[D_DUE] |

| Mitigation | $[MIT_CLAIMED] | $[MIT_PAID] | $[MIT_DUE] |

| SUBTOTAL | $[SUBTOTAL_DUE] | ||

| Less Deductible | ($[DEDUCTIBLE]) | ||

| TOTAL DUE | $[TOTAL_DUE] |

VII. OVERHEAD AND PROFIT

Our client is entitled to general contractor overhead and profit because:

- The repairs require coordination of multiple trades

- The scope and complexity exceeds simple repairs

- A general contractor is reasonably necessary

- Industry standard is [___]% overhead and [___]% profit

[CARRIER_SHORT_NAME]'s refusal to include O&P is contrary to Florida law and industry standards.

VIII. APPRAISAL DEMAND (IF APPLICABLE)

A. Invoking Appraisal

Due to [CARRIER_SHORT_NAME]'s failure to fairly evaluate this claim, we hereby invoke the appraisal process under the policy and Florida law.

We appoint [APPRAISER_NAME] as our client's appraiser.

Please provide [CARRIER_SHORT_NAME]'s appraiser within [NUMBER] days.

B. Scope of Appraisal

The following items are submitted to appraisal:

- Amount of loss to dwelling (Coverage A)

- Amount of loss to other structures (Coverage B)

- Amount of loss to personal property (Coverage C)

- [SPECIFIC_DISPUTED_ITEMS]

Note: Coverage questions are reserved for litigation.

IX. STATUTORY VIOLATIONS AND BAD FAITH

A. Florida Prompt Payment Violations

[CARRIER_SHORT_NAME] has violated Fla. Stat. 627.70131 - 90 days to pay or deny claim; 10% penalty interest by:

- [VIOLATION_1]

- [VIOLATION_2]

- [VIOLATION_3]

B. Unfair Claims Settlement Practices

[CARRIER_SHORT_NAME] has violated Fla. Stat. 626.9541 by:

- Misrepresenting pertinent facts or policy provisions

- Failing to acknowledge and act promptly on communications

- Failing to adopt reasonable investigation standards

- Not attempting good faith settlement when liability is clear

- Compelling litigation by offering substantially less than owed

- Failing to provide reasonable explanation for denial/delay

C. Bad Faith

Under Florida law:

Florida recognizes both statutory (Fla. Stat. 624.155) and common law bad faith. As of HB 837 (2023), claimants must show more than negligence - insurer must have acted with intentional misconduct or reckless disregard. 90-day safe harbor for liability claims. Conduct of all parties considered. Civil Remedy Notice (CRN) required before suit.

Available remedies include: Damages in excess of policy limits, consequential damages, emotional distress, punitive damages, and attorney fees

X. DEMAND

A. Monetary Demand

We demand payment of $[TOTAL_DEMAND]:

| Item | Amount |

|---|---|

| Dwelling (Coverage A) | $[A_AMOUNT] |

| Other Structures (Coverage B) | $[B_AMOUNT] |

| Personal Property (Coverage C) | $[C_AMOUNT] |

| Loss of Use (Coverage D) | $[D_AMOUNT] |

| Mitigation | $[MIT_AMOUNT] |

| Statutory Interest/Penalties | $[PENALTIES] |

| SUBTOTAL | $[SUBTOTAL] |

| Less Deductible | ($[DEDUCTIBLE]) |

| Less Prior Payments | ($[PRIOR_PAYMENTS]) |

| TOTAL DUE | $[TOTAL_DUE] |

XI. RESPONSE DEADLINE AND CONSEQUENCES

This demand must be accepted by 5:00 p.m. [TIME_ZONE] on [RESPONSE_DEADLINE].

Consequences of Non-Response

If [CARRIER_SHORT_NAME] fails to accept this demand:

-

Litigation will be filed in Florida seeking:

- All policy benefits

- Statutory penalties and interest

- Bad faith damages

- Punitive damages (where available)

- Attorney's fees and costs -

Regulatory complaints will be filed with:

- Florida Office of Insurance Regulation, 200 E. Gaines Street, Tallahassee, FL 32399

- National Association of Insurance Commissioners -

Appraisal will be invoked (if not already)

XII. DOCUMENT PRESERVATION NOTICE

This letter serves as notice to preserve all documents and ESI related to this claim.

XIII. CONCLUSION

[CARRIER_SHORT_NAME] sold our client a policy promising protection against property losses. That loss has occurred. The coverage is clear. The only thing missing is payment.

Respectfully submitted,

[LAW_FIRM_NAME]

By: _______________________________

[ATTORNEY_NAME]

[BAR_NUMBER]

[ADDRESS]

[CITY], FL [ZIP]

[PHONE]

[EMAIL]

Counsel for [CLIENT_NAME]

ENCLOSURES:

- Policy declarations page

- Relevant policy provisions

- Contractor estimates

- Photographs of damage

- Personal property inventory

- Supporting documentation

CC:

- [CLIENT_NAME]

- [MORTGAGEE_NAME] (if applicable)

- Florida Office of Insurance Regulation, 200 E. Gaines Street, Tallahassee, FL 32399

FLORIDA PROPERTY INSURANCE LAW QUICK REFERENCE

| Element | Florida Law |

|---|---|

| Prompt Payment | Fla. Stat. 627.70131 - 90 days to pay or deny claim; 10% penalty interest |

| Appraisal | Fla. Stat. 627.7015 - Residential property appraisal requirements |

| Bad Faith Type | Statutory and Common Law |

| Bad Faith Damages | Damages in excess of policy limits, consequential damages, emotional distress, punitive damages, and attorney fees |

| Unfair Practices Act | Fla. Stat. 626.9541 |

| Attorney Fees | Recoverable under Fla. Stat. 627.428 (post-2023 limited for some claims) |

| DOI Address | Florida Office of Insurance Regulation, 200 E. Gaines Street, Tallahassee, FL 32399 |

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

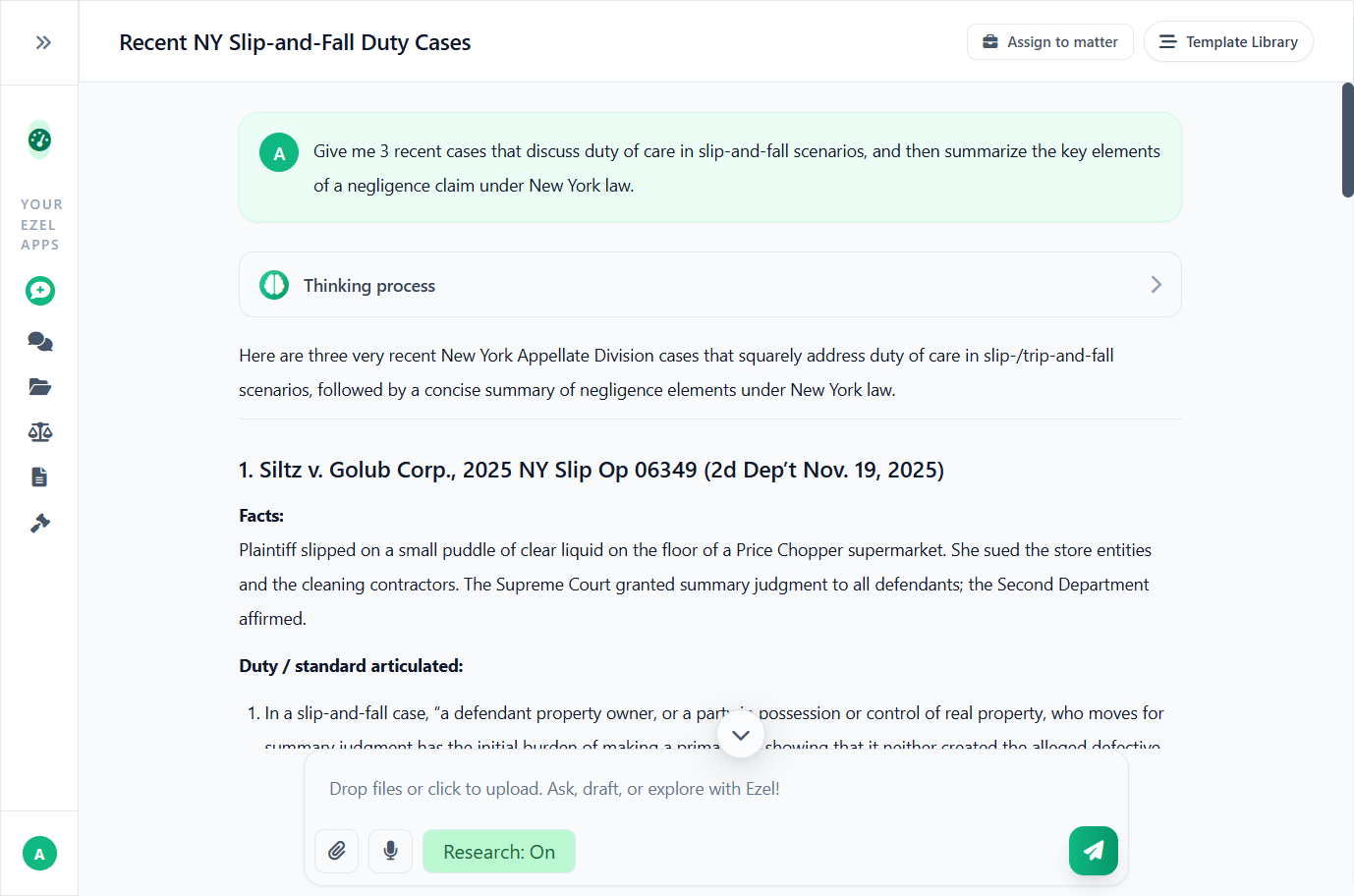

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

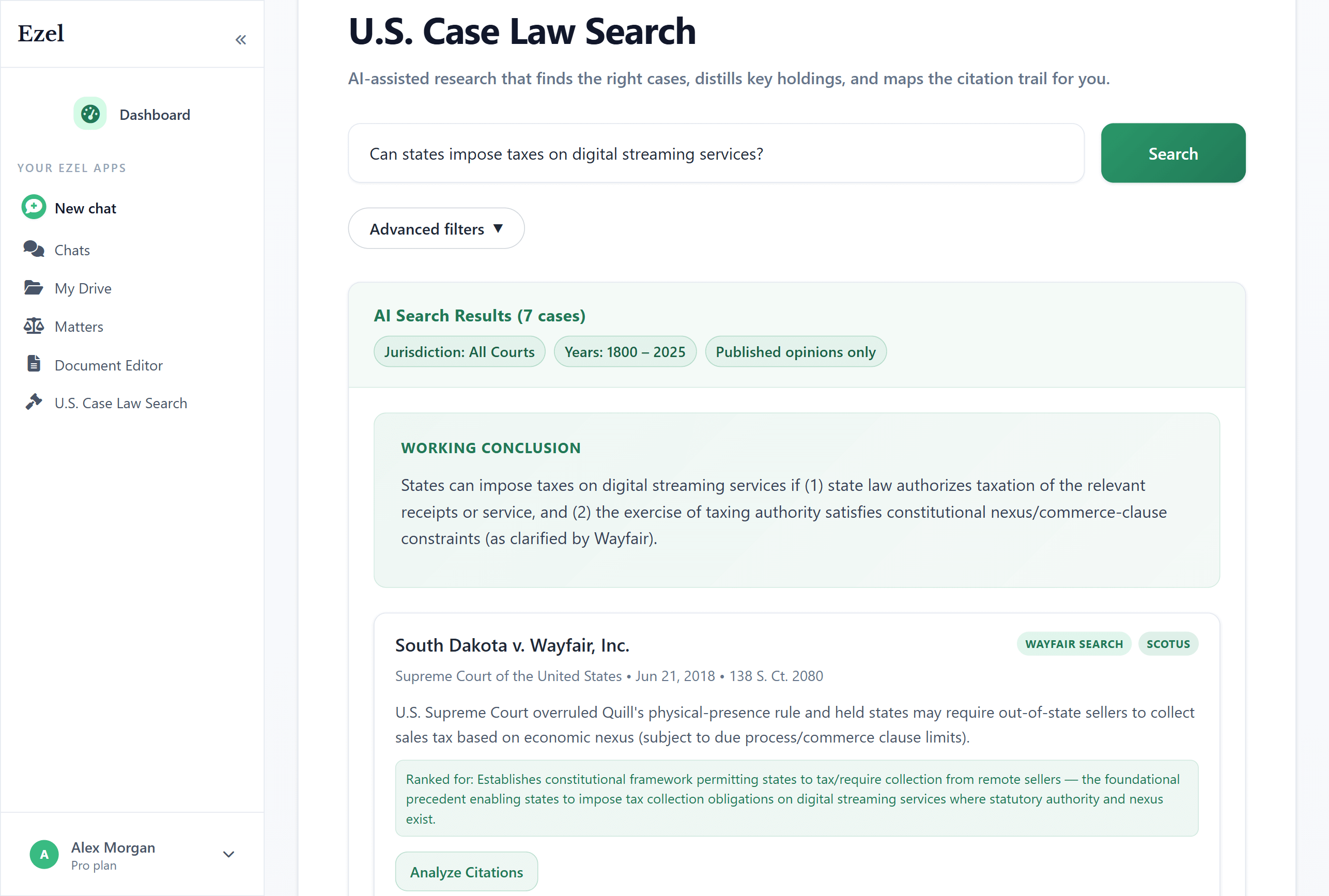

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.