FAIR CREDIT REPORTING ACT VIOLATION DEMAND LETTER

STATE OF OKLAHOMA

SENT VIA CERTIFIED MAIL, RETURN RECEIPT REQUESTED

AND FIRST-CLASS MAIL

[DATE]

[RECIPIENT NAME - CRA OR FURNISHER]

[RECIPIENT ADDRESS]

[CITY, STATE ZIP]

Re: FCRA Violation Demand - Willful and/or Negligent Noncompliance

Consumer: [CONSUMER FULL NAME]

SSN (Last 4): XXX-XX-[LAST 4 DIGITS]

Date of Birth: [DOB]

Current Address: [CONSUMER ADDRESS]

File/Reference Number: [IF APPLICABLE]

Dear Sir or Madam:

This law firm represents [CONSUMER FULL NAME] ("Consumer" or "Client") regarding your violations of the Fair Credit Reporting Act ("FCRA"), 15 U.S.C. Section 1681 et seq., and applicable Oklahoma state law. Please direct all future communications regarding this matter to our office.

I. INTRODUCTION AND NATURE OF CLAIM

This letter constitutes formal notice that your conduct has violated the Fair Credit Reporting Act and potentially Oklahoma state consumer protection laws. Our Client has suffered concrete harm as a direct result of your failure to comply with applicable law, and we are prepared to pursue all available legal remedies unless this matter is resolved promptly.

TYPE OF DEFENDANT:

[ ] Consumer Reporting Agency ("CRA") - Equifax, Experian, TransUnion, or other CRA

[ ] Furnisher of Information - Creditor, debt collector, or other entity that furnished information

[ ] User of Consumer Reports - Entity that obtained and used our Client's consumer report

II. OKLAHOMA-SPECIFIC LEGAL FRAMEWORK

A. Federal FCRA Application in Oklahoma

The Fair Credit Reporting Act applies with full force in Oklahoma through federal preemption. However, 15 U.S.C. Section 1681t(a) preserves state law claims that are not inconsistent with federal law, and Section 1681h(e) allows state defamation, invasion of privacy, and negligence claims when malice or willful intent is shown.

B. Oklahoma Consumer Protection Act

The Oklahoma Consumer Protection Act ("OCPA"), 15 Okl. St. Section 751 et seq., provides comprehensive consumer protection against deceptive trade practices.

Relevant OCPA Provisions:

- Section 752 prohibits deceptive trade practices

- Section 753 defines prohibited practices including misrepresentations

- Section 761.1 provides for private causes of action

OCPA Remedies: Under 15 Okl. St. Section 761.1, consumers may recover actual damages plus reasonable attorney's fees. The court may award additional damages up to the amount of actual damages for willful violations.

C. Oklahoma Credit Services Organization Act

24 Okl. St. Section 131 et seq. regulates credit services organizations and provides additional consumer protections.

D. Oklahoma Security Freeze Law

Oklahoma's security freeze provisions, 24 Okl. St. Section 161 et seq., provide consumers the right to:

- Place a security freeze on their credit report

- Temporarily lift or remove the freeze

- Receive protection from identity theft

Security Freeze Rights: Under 24 Okl. St. Section 162, Oklahoma consumers have the right to place a security freeze free of charge.

E. Oklahoma Identity Theft Victim Protection

Oklahoma provides identity theft victim protections under 21 Okl. St. Section 1533.1 et seq., criminalizing identity theft and providing remedies for victims.

F. Statute of Limitations

| Claim Type | Limitations Period | Citation |

|---|---|---|

| Federal FCRA | 2 years from discovery, max 5 years from violation | 15 U.S.C. Section 1681p |

| Oklahoma CPA | 2 years | 15 Okl. St. Section 761.1 |

| Defamation | 1 year | 12 Okl. St. Section 95(4) |

| Negligence | 2 years | 12 Okl. St. Section 95(3) |

G. Oklahoma Attorney General Enforcement

The Oklahoma Attorney General has authority to enforce consumer protection laws. Consumer complaints may be filed with the Oklahoma Attorney General's Consumer Protection Unit.

III. SUMMARY OF VIOLATIONS

Based on our investigation, we have identified the following FCRA violations:

Consumer Reporting Agency Violations:

[ ] Failure to follow reasonable procedures to assure maximum possible accuracy (15 U.S.C. Section 1681e(b))

[ ] Failure to conduct reasonable reinvestigation upon dispute (15 U.S.C. Section 1681i(a))

[ ] Failure to provide results of reinvestigation within 30 days (15 U.S.C. Section 1681i(a)(1))

[ ] Failure to delete inaccurate or unverifiable information (15 U.S.C. Section 1681i(a)(5))

[ ] Failure to provide free annual disclosure (15 U.S.C. Section 1681j)

[ ] Failure to provide file disclosure upon request (15 U.S.C. Section 1681g)

[ ] Failure to provide notice of negative information (15 U.S.C. Section 1681m)

[ ] Improper reinsertion of previously deleted information (15 U.S.C. Section 1681i(a)(5)(B))

Furnisher Violations:

[ ] Furnishing information known to be inaccurate (15 U.S.C. Section 1681s-2(a)(1)(A))

[ ] Failure to correct and update information (15 U.S.C. Section 1681s-2(a)(2))

[ ] Failure to provide notice of dispute (15 U.S.C. Section 1681s-2(a)(3))

[ ] Failure to conduct reasonable investigation upon notice of dispute (15 U.S.C. Section 1681s-2(b)(1))

[ ] Failure to review all relevant information provided by CRA (15 U.S.C. Section 1681s-2(b)(1)(A))

[ ] Failure to report results of investigation to CRA (15 U.S.C. Section 1681s-2(b)(1)(C))

[ ] Failure to modify, delete, or permanently block inaccurate information (15 U.S.C. Section 1681s-2(b)(1)(D))

User Violations:

[ ] Obtaining consumer report without permissible purpose (15 U.S.C. Section 1681b)

[ ] Failure to provide adverse action notice (15 U.S.C. Section 1681m(a))

[ ] Failure to provide risk-based pricing notice (15 U.S.C. Section 1681m(h))

IV. STATEMENT OF FACTS

A. Background

Our Client, [CONSUMER FULL NAME], is a resident of Oklahoma and a consumer as defined by 15 U.S.C. Section 1681a(c). [DEFENDANT NAME] is a [consumer reporting agency/furnisher of information/user of consumer reports] as defined by the FCRA.

B. The Inaccurate Information

The following inaccurate information has been/is being reported on our Client's consumer credit report:

| Item | Account/Creditor | Reported Information | Accurate Information | CRA(s) Affected |

|---|---|---|---|---|

| 1 | [NAME] | [WHAT IS BEING REPORTED] | [WHAT SHOULD BE REPORTED] | [ ] Equifax [ ] Experian [ ] TransUnion |

| 2 | [NAME] | [WHAT IS BEING REPORTED] | [WHAT SHOULD BE REPORTED] | [ ] Equifax [ ] Experian [ ] TransUnion |

| 3 | [NAME] | [WHAT IS BEING REPORTED] | [WHAT SHOULD BE REPORTED] | [ ] Equifax [ ] Experian [ ] TransUnion |

C. Dispute History

Our Client has properly disputed this inaccurate information as follows:

Dispute #1:

- Date of Dispute: [DATE]

- Method: [ ] Online [ ] Mail [ ] Telephone [ ] Direct to Furnisher

- Dispute Description: [SUMMARY OF DISPUTE]

- Response Date: [DATE]

- Response: [SUMMARY - Verified as accurate/Modified/Deleted/No response]

- Confirmation Number: [IF APPLICABLE]

Dispute #2:

- Date of Dispute: [DATE]

- Method: [ ] Online [ ] Mail [ ] Telephone [ ] Direct to Furnisher

- Dispute Description: [SUMMARY OF DISPUTE]

- Response Date: [DATE]

- Response: [SUMMARY]

- Confirmation Number: [IF APPLICABLE]

D. Evidence of Inaccuracy

Our Client possesses documentation proving the reported information is inaccurate, including:

[ ] Court records (bankruptcy discharge, judgment satisfaction, case dismissal)

[ ] Payment records and receipts

[ ] Account statements showing accurate information

[ ] Identity theft report (FTC Affidavit)

[ ] Police report filed with Oklahoma law enforcement

[ ] Correspondence with creditor

[ ] Other: [SPECIFY]

V. LEGAL ANALYSIS

A. Federal FCRA Violations

1. Maximum Possible Accuracy - Section 1681e(b)

The FCRA requires CRAs to "follow reasonable procedures to assure maximum possible accuracy of the information concerning the individual about whom the report relates." 15 U.S.C. Section 1681e(b).

You violated this requirement by: [SPECIFY HOW CRA FAILED TO MAINTAIN ACCURACY]

2. Reasonable Reinvestigation - Section 1681i(a)

Upon receiving a consumer dispute, a CRA must "conduct a reasonable reinvestigation to determine whether the disputed information is inaccurate." 15 U.S.C. Section 1681i(a)(1).

A "reasonable" reinvestigation requires more than merely parroting information received from the furnisher. See Cushman v. Trans Union Corp., 115 F.3d 220, 225 (3d Cir. 1997).

You violated this requirement by: [SPECIFY HOW REINVESTIGATION WAS UNREASONABLE]

B. Oklahoma State Law Violations

1. Oklahoma Consumer Protection Act

Your continued reporting of inaccurate information and failure to conduct reasonable investigations constitutes deceptive trade practices under Oklahoma law. Under 15 Okl. St. Section 752:

- Misrepresenting the characteristics of consumer information

- Making false or misleading statements concerning consumer credit data

- Engaging in practices which offend established public policy

The Oklahoma Supreme Court has held that the OCPA should be liberally construed to protect consumers. See Patterson v. Beall, 2000 OK 92.

2. Additional Damages for Willful Violations

Under 15 Okl. St. Section 761.1(C), if the court finds the violation was willful, it may award additional damages up to the amount of actual damages.

C. Willfulness

Your violations were willful within the meaning of 15 U.S.C. Section 1681n. Under Safeco Insurance Co. of America v. Burr, 551 U.S. 47 (2007), a violation is willful if it is either knowing or reckless. Your conduct was [knowing/reckless] because:

[EXPLAIN WHY CONDUCT WAS WILLFUL]

VI. DAMAGES

A. Actual Damages

Our Client has suffered the following actual damages:

Credit-Related Damages:

[ ] Denial of credit: [DESCRIBE]

[ ] Increased interest rates: [CALCULATE ADDITIONAL COST]

[ ] Denial of housing/apartment application

[ ] Employment denial or adverse action

[ ] Security deposit requirements

Emotional Distress:

[ ] Anxiety and worry

[ ] Embarrassment and humiliation

[ ] Frustration from repeated disputes

[ ] Loss of sleep

Out-of-Pocket Expenses:

[ ] Credit monitoring services: $[AMOUNT]

[ ] Certified mail and postage: $[AMOUNT]

[ ] Time spent disputing: $[AMOUNT]

B. Statutory Damages - Federal FCRA

For willful violations, our Client is entitled to statutory damages of $100-$1,000 per violation under 15 U.S.C. Section 1681n(a)(1)(A).

C. Additional Damages - Oklahoma CPA

For willful violations of the Oklahoma Consumer Protection Act, our Client may be entitled to additional damages up to the amount of actual damages under 15 Okl. St. Section 761.1(C).

D. Punitive Damages

Punitive damages are available under 15 U.S.C. Section 1681n(a)(2) for willful FCRA violations.

E. Attorney's Fees and Costs

As the prevailing party, our Client is entitled to recover reasonable attorney's fees under both federal law and 15 Okl. St. Section 761.1.

VII. PRESERVATION OF EVIDENCE

You are hereby placed on notice to preserve all documents and electronically stored information relating to our Client, including but not limited to:

- Complete credit file and all versions thereof

- All dispute records, investigation notes, and correspondence

- All communications with furnishers regarding our Client

- All ACDV/AUD forms and e-OSCAR records

- Policies and procedures for investigating disputes

- Training materials for dispute investigation personnel

VIII. DEMAND FOR SETTLEMENT

To resolve this matter without litigation, we demand:

Immediate Corrective Action:

- Deletion/Correction: Immediate permanent deletion or correction of all inaccurate information

- Written Confirmation: Written confirmation within fourteen (14) days

- Suppression Code: Application of codes to prevent reinsertion

Monetary Compensation:

Payment of $[SETTLEMENT DEMAND] within thirty (30) days, representing:

| Category | Amount |

|---|---|

| Statutory Damages | $[AMOUNT] |

| Actual Damages | $[AMOUNT] |

| Oklahoma CPA Damages | $[AMOUNT] |

| Attorney's Fees to Date | $[AMOUNT] |

| TOTAL DEMAND | $[TOTAL] |

IX. RESPONSE REQUIRED

Please respond to this demand in writing within thirty (30) days. If we do not receive a satisfactory response, we will file suit in the United States District Court for the Eastern, Northern, or Western District of Oklahoma or appropriate Oklahoma state court.

X. CONCLUSION

The FCRA and Oklahoma consumer protection laws exist to ensure accuracy in consumer credit reporting. Your violations have caused our Client significant harm. We prefer to resolve this matter amicably but are fully prepared to litigate if necessary.

All rights reserved.

Respectfully submitted,

[LAW FIRM NAME]

By: _________________________________

[ATTORNEY NAME]

Oklahoma Bar Association No. [NUMBER]

[ADDRESS]

[CITY, OKLAHOMA ZIP]

[TELEPHONE]

[EMAIL]

Attorneys for [CONSUMER FULL NAME]

ENCLOSURES:

[ ] Consumer credit reports showing inaccurate information

[ ] Dispute letters and correspondence

[ ] CRA responses to disputes

[ ] Documentation proving inaccuracy

[ ] Evidence of damages

[ ] Authorization to represent

cc: [CONSUMER NAME] (via email)

[CLIENT FILE]

OKLAHOMA-SPECIFIC PRACTICE NOTES

[ ] Federal Venue: Eastern District (Muskogee), Northern District (Tulsa), or Western District (Oklahoma City)

[ ] State Court Option: Oklahoma District Courts have concurrent jurisdiction over FCRA claims under 15 U.S.C. Section 1681p

[ ] Oklahoma AG Complaints: File with Oklahoma Attorney General, Consumer Protection Unit, 313 NE 21st Street, Oklahoma City, OK 73105

[ ] Security Freeze: Oklahoma consumers can place free security freezes under 24 Okl. St. Section 162

[ ] Identity Theft Victims: May obtain free credit reports and place fraud alerts under both federal and Oklahoma law

[ ] OCPA Considerations: 2-year statute of limitations; ensure timely filing of state law claims

This template is for informational purposes only and does not constitute legal advice. Consult with a licensed attorney in Oklahoma before use.

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

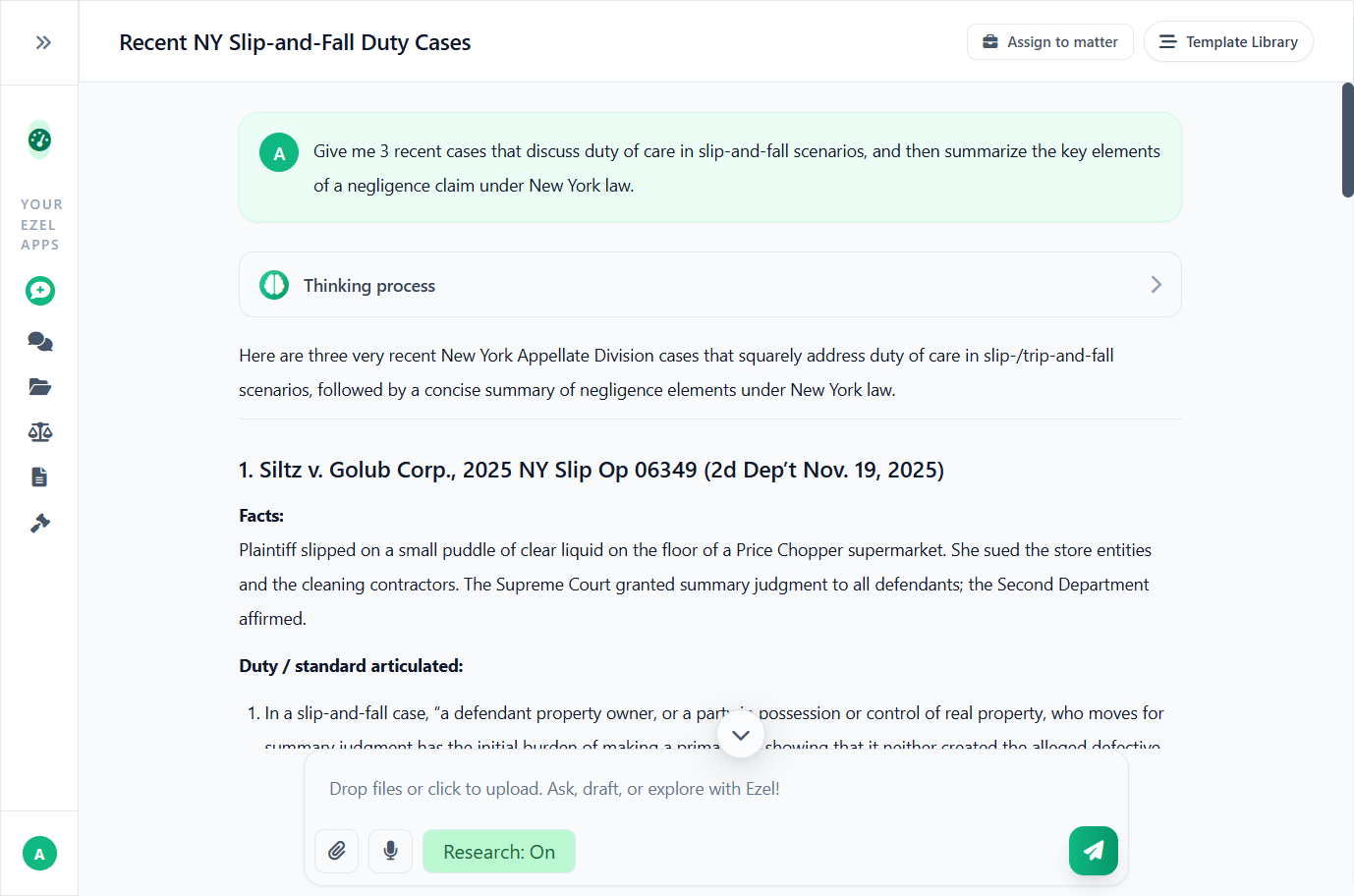

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

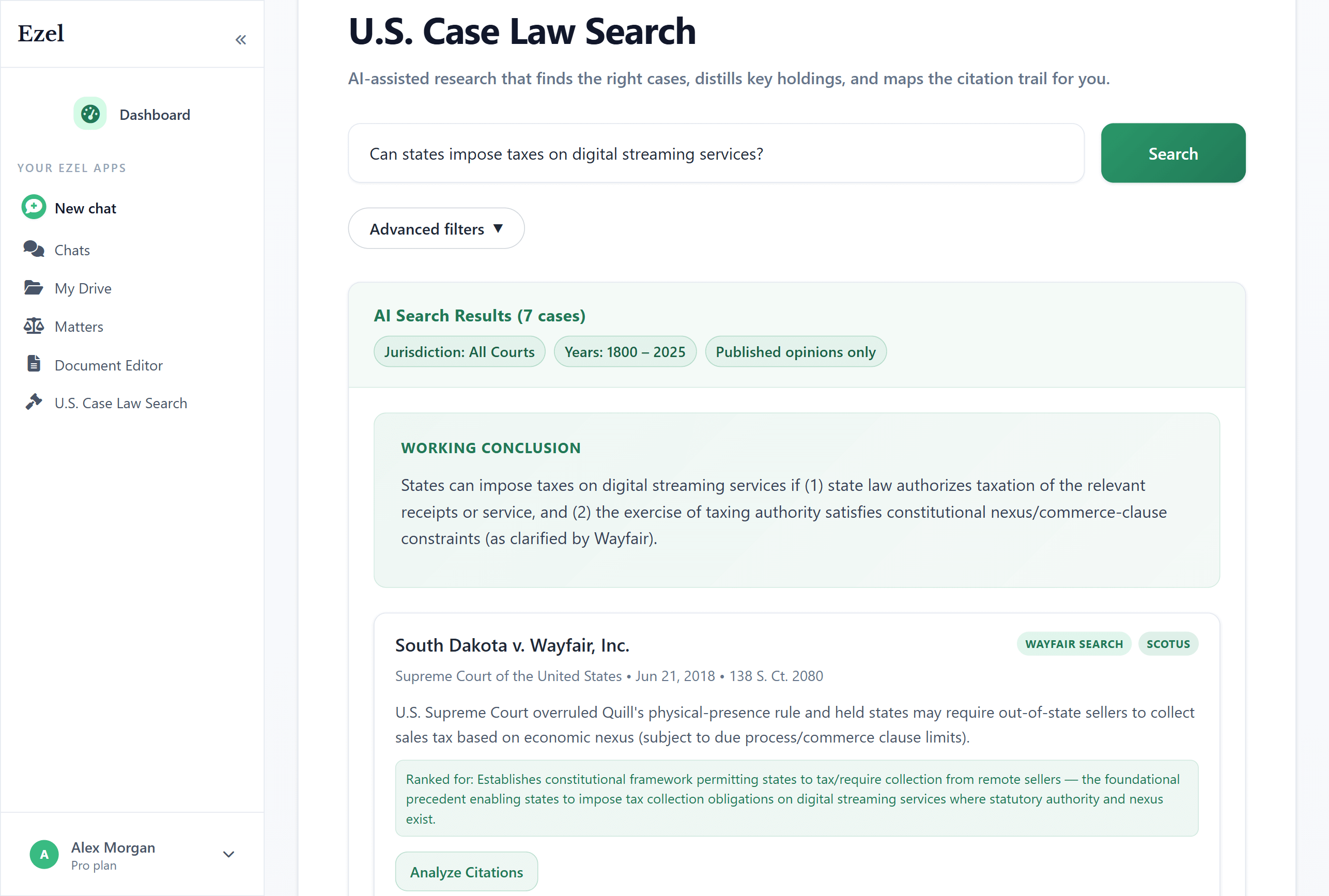

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.