DEBT COLLECTION DEMAND LETTER & VALIDATION NOTICE

(FDCPA-Compliant – Universal/Choice of Law Template)

[// GUIDANCE: This template is intentionally more robust than a typical one-page demand letter. It is designed for sophisticated creditors, collection agencies, or law firms that want a court-ready document that anticipates common challenges under the Fair Debt Collection Practices Act (“FDCPA”) and similar state statutes. Remove any inapplicable provisions before use.]

TABLE OF CONTENTS

I. Document Header

II. Definitions

III. Operative Provisions

IV. Representations & Warranties

V. Covenants & Restrictions

VI. Default & Remedies

VII. Risk Allocation

VIII. Dispute Resolution

IX. General Provisions

X. Execution Block

I. DOCUMENT HEADER

-

Title

“DEBT COLLECTION DEMAND LETTER & VALIDATION NOTICE” -

Parties

a. Creditor: [LEGAL NAME OF CURRENT OWNER OF DEBT]

b. Collector: [LEGAL NAME OF COLLECTION AGENCY/LAW FIRM]

c. Debtor: [CONSUMER’S FULL LEGAL NAME] -

Effective Date

This Letter is effective as of [DATE] (the “Effective Date”). -

Jurisdiction

This communication is governed by the Fair Debt Collection Practices Act, 15 U.S.C. §§ 1692 et seq., and, where applicable, comparable state debt collection laws (collectively, the “Governing Law”). -

Recitals

WHEREAS, the Debtor incurred a financial obligation to the Creditor in the original principal amount of $[ORIGINAL PRINCIPAL];

WHEREAS, the Debt is presently due and owing in the total amount of $[TOTAL OUTSTANDING AMOUNT] (the “Debt Amount”); and

WHEREAS, the Collector has been duly engaged to collect the Debt on behalf of the Creditor.

II. DEFINITIONS

For purposes of this Letter, capitalized terms have the meanings set forth below:

“Business Day” – Any day other than a Saturday, Sunday, or federal legal holiday.

“Debt” – The unpaid account, loan, or other obligation described in Section I.5, including all authorized interest, fees, and charges permissible under applicable law.

“Debt Amount” – The total sum demanded in Section I.5, subject to verified adjustment.

“Debtor” – The individual consumer identified in Section I.2(c).

“Validation Period” – The thirty (30)-day period beginning on the Debtor’s receipt of this Letter, as contemplated by 15 U.S.C. § 1692g(a).

[// GUIDANCE: Add or delete defined terms to reflect the actual transaction.]

III. OPERATIVE PROVISIONS

-

Demand for Payment

a. The Debtor is hereby DEMANDED to pay the Debt Amount in full no later than [DATE – typically 30 days from Debtor’s receipt] (the “Payment Deadline”).

b. Acceptable payment methods include: [LIST – e.g., certified check, electronic ACH, online portal]. -

FDCPA Validation Notice

Pursuant to 15 U.S.C. § 1692g(a):

i. Unless the Debtor, within the Validation Period, disputes the validity of the Debt or any portion thereof, the Debt will be assumed valid by the Collector.

ii. If the Debtor notifies the Collector in writing within the Validation Period that the Debt, or any portion thereof, is disputed, the Collector will obtain verification of the Debt and mail a copy of such verification to the Debtor.

iii. Upon written request within the Validation Period, the Collector will provide the Debtor with the name and address of the original creditor, if different from the current creditor. -

Mini-Miranda Disclosure

THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. -

Payment Application

Payments will be applied first to accrued interest (if any), second to fees or costs permitted by law, and last to principal, unless otherwise required by Governing Law. -

Interest & Fees Post-Date

Interest, late charges, and other permissible fees may continue to accrue after the Effective Date, as allowed by Governing Law and the applicable contract. -

Cease-Communication & Special Requests

The Debtor may, at any time, exercise rights under 15 U.S.C. § 1692c to limit or cease further communications from the Collector by sending a written request to the address in Section X.

IV. REPRESENTATIONS & WARRANTIES

-

Collector’s Authority

The Collector represents that it is duly licensed and/or authorized to engage in debt collection activities in all jurisdictions where such licensure is required. -

Accuracy of Information

The Creditor and Collector warrant that, to the best of their current knowledge, the Debt information herein is accurate and complete. -

No Waiver of FDCPA Compliance

Nothing in this Letter shall be construed to waive, limit, or modify any obligation imposed by the FDCPA or applicable state law. -

Survival

The representations and warranties in this Section shall survive until the Debt is paid in full or otherwise legally discharged.

V. COVENANTS & RESTRICTIONS

-

Debtor’s Covenant to Pay or Dispute

The Debtor shall, on or before the Payment Deadline, either (a) remit full payment, (b) propose a mutually agreeable repayment arrangement, or (c) submit a timely written dispute in accordance with Section III.2. -

Mutual Duty of Good Faith

All Parties shall act in good faith and in compliance with Governing Law in connection with all communications and negotiations concerning the Debt.

VI. DEFAULT & REMEDIES

-

Events of Default

The occurrence of any of the following before resolution of the Debt constitutes an “Event of Default”:

a. Failure to pay the Debt Amount or enter a written payment agreement by the Payment Deadline;

b. Failure to timely perform any covenant in Section V.1; or

c. Any intentional misrepresentation by the Debtor concerning the Debt. -

Notice & Cure

The Collector shall provide the Debtor with written notice of any Event of Default and a cure period of ten (10) Business Days from the Debtor’s receipt of such notice, unless otherwise mandated by Governing Law. -

Graduated Remedies

If an Event of Default is not cured within the applicable cure period, the Collector may, subject to Governing Law:

a. Commence a civil action to recover the Debt, plus permissible costs and attorney fees;

b. Report the delinquency to consumer reporting agencies in compliance with the Fair Credit Reporting Act (15 U.S.C. §§ 1681 et seq.); and/or

c. Pursue any other lawful remedy available at law or in equity.

VII. RISK ALLOCATION

- Limitation of Liability

To the fullest extent permitted by Governing Law, the aggregate liability of the Creditor and Collector to the Debtor arising out of or in connection with this Letter shall not exceed the Debt Amount, exclusive of any statutory damages, attorney fees, or costs recoverable by the Debtor under the FDCPA or other applicable law.

[// GUIDANCE: FDCPA liability cannot be waived. This clause is intended to cap extra-contractual or tort claims; remove if inconsistent with client risk tolerance or local law.]

VIII. DISPUTE RESOLUTION

-

Governing Law

This Letter, and any dispute arising hereunder, shall be governed by federal law, including the FDCPA, and, to the extent not pre-empted, the laws of the state in which the Debtor resides. -

Forum Selection

Exclusive jurisdiction for any suit arising from or relating to this Letter shall lie in either (a) the United States District Court having jurisdiction over the Debtor’s county of residence, or (b) the state court of competent jurisdiction located in that county. -

Arbitration & Jury Waiver

Not applicable. -

Injunctive Relief

Not applicable.

IX. GENERAL PROVISIONS

-

Entire Agreement

This Letter contains the entire communication regarding the Debt as of the Effective Date and supersedes all prior oral or written communications on the subject. -

Amendment & Waiver

No amendment or waiver of any provision of this Letter shall be effective unless in a signed writing. A waiver on one occasion is not a waiver on any other occasion. -

Assignment

The Creditor may assign its rights in the Debt in compliance with Governing Law. The Debtor may not assign any obligations without prior written consent of the Creditor. -

Severability

If any provision of this Letter is held invalid or unenforceable, the remaining provisions shall remain in full force and effect, and the invalid provision shall be reformed to the minimum extent necessary to comply with Governing Law. -

Electronic Signatures

Signatures transmitted electronically (e.g., PDF, facsimile, or via secure electronic signature platform) shall be deemed original and enforceable.

X. EXECUTION BLOCK

IN WITNESS WHEREOF, the Parties have caused this Letter to be executed as of the Effective Date.

Creditor:

________________________________________

[NAME & TITLE]

[LEGAL NAME OF CREDITOR]

[ADDRESS]

[PHONE]

[EMAIL]

Collector:

________________________________________

[NAME & TITLE]

[LEGAL NAME OF COLLECTOR/LAW FIRM]

[LICENSE OR REGISTRATION NO.]

[ADDRESS]

[PHONE]

[EMAIL]

ACKNOWLEDGED:

Debtor:

________________________________________

[DEBTOR NAME] (signature optional unless executing payment agreement)

[ADDRESS]

[// GUIDANCE: The Debtor signature line is not required for a unilateral demand letter, but may be used to memorialize a payment plan or settlement. Remove if unnecessary.]

PAYMENT REMITTANCE INFORMATION

Make checks payable to: [PAYEE]

Mail to: [PAYMENT ADDRESS]

Online payments: [SECURE PAYMENT URL]

Reference Account No.: [ACCOUNT/FILE NUMBER]

[// GUIDANCE:

1. Prior to issuance, confirm that all state-specific disclosures (e.g., California “Rosenthal” notice, New York Department of Financial Services disclosure, etc.) are appended where required.

2. Verify that required licenses are active in the Debtor’s state.

3. Do NOT include any impermissible threats or misstatements that could violate 15 U.S.C. § 1692e or state law equivalents.

4. Ensure the Validation Notice is not overshadowed by the demand for immediate payment—avoid bold, underlining, or larger font on payment demands that visually dominate Section III.2.

5. Keep an internal record of delivery method and date to establish the Validation Period.]

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

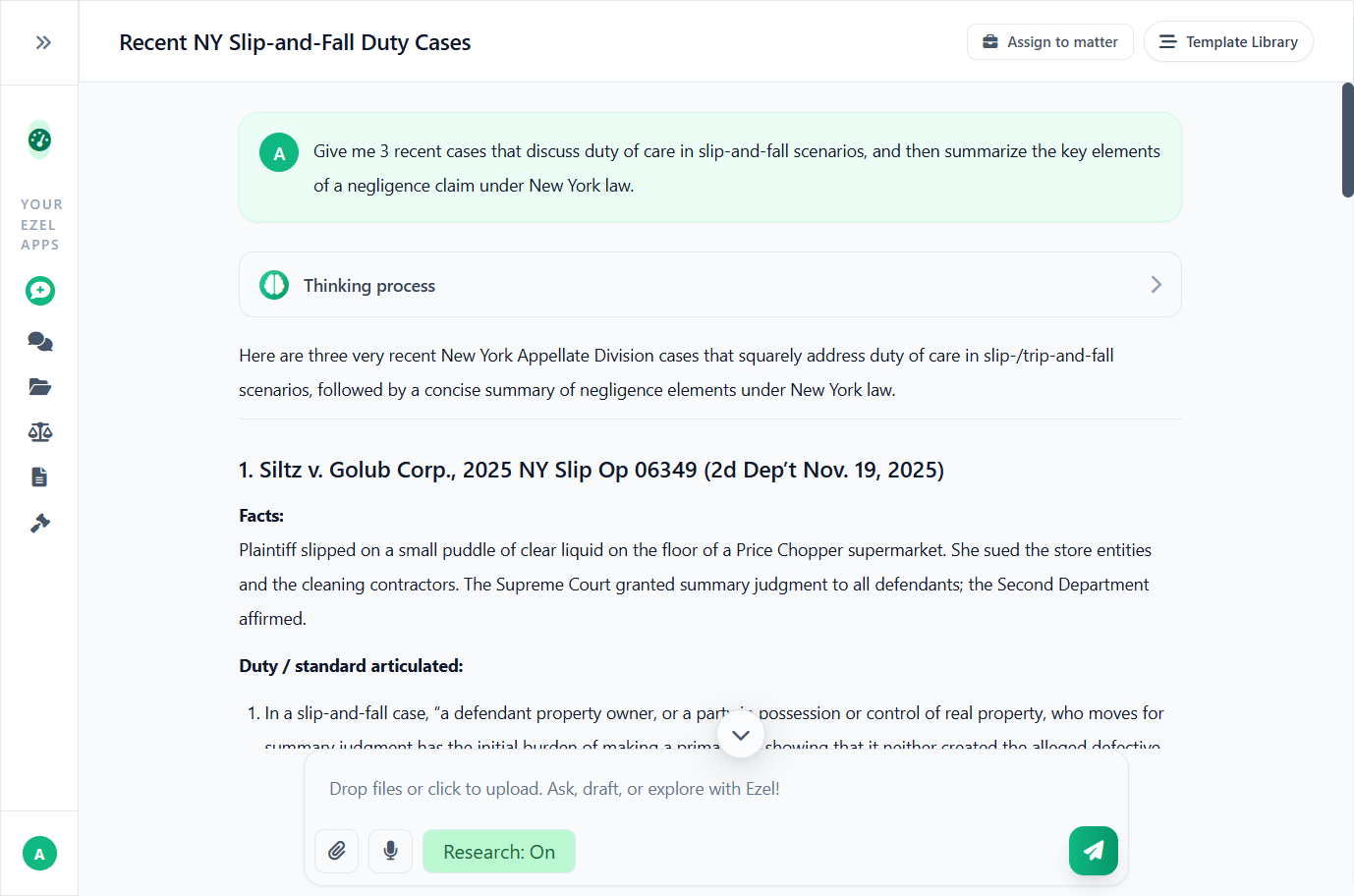

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

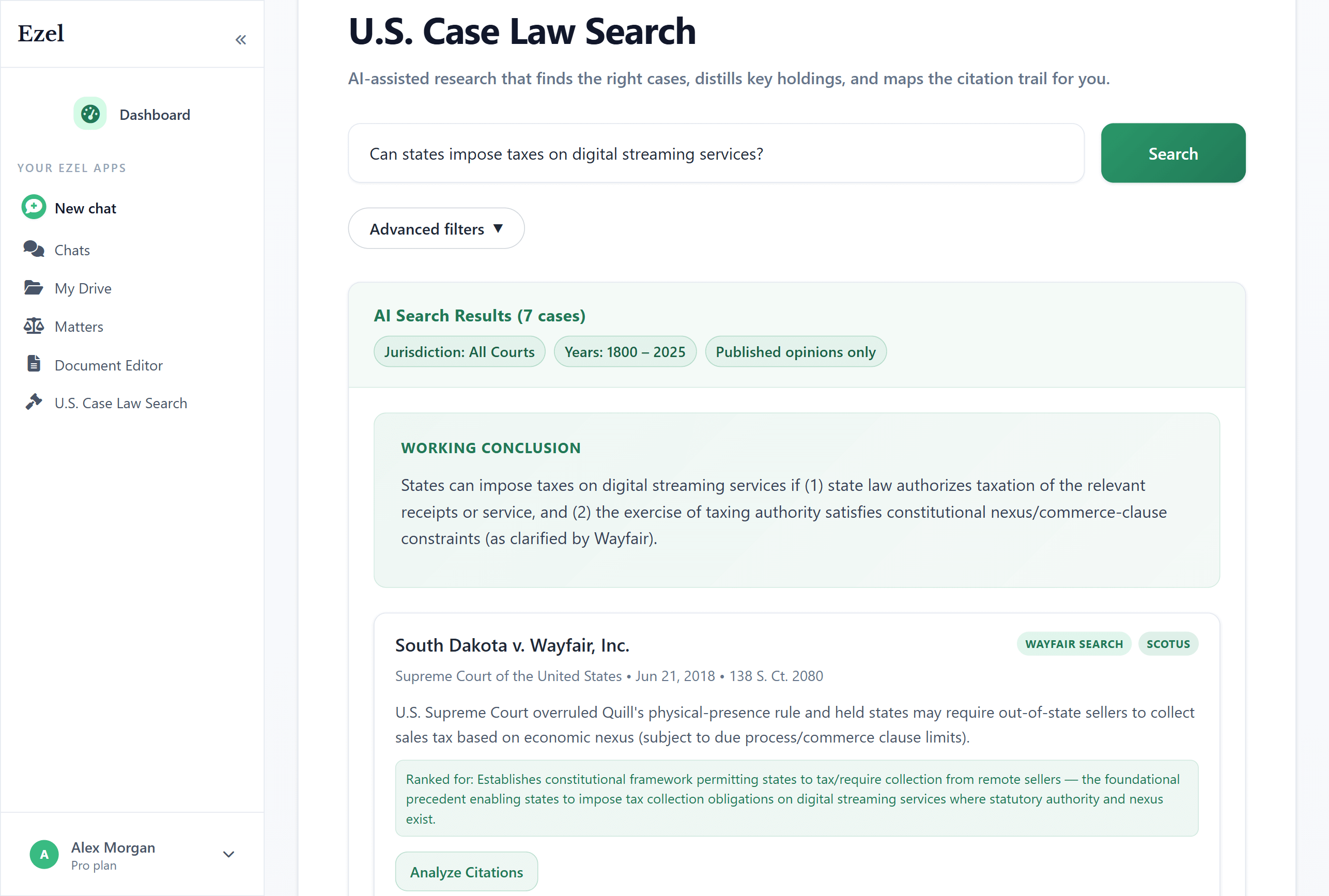

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.