DEMAND FOR SETTLEMENT - MOTOR VEHICLE COLLISION

STATE OF CALIFORNIA

[FIRM NAME]

Attorneys at Law

[Street Address]

[City, California ZIP]

Telephone: [Phone]

Facsimile: [Fax]

Email: [Email]

Licensed in the State of California

DATE: [Date]

VIA CERTIFIED MAIL, RETURN RECEIPT REQUESTED

[Adjuster Name]

[Insurance Company Name]

[Street Address]

[City, State ZIP]

RE: SETTLEMENT DEMAND - MOTOR VEHICLE COLLISION

Our Client: [Client Full Name]

Date of Loss: [Date of Accident]

Your Insured: [At-Fault Driver Name]

Claim Number: [Claim Number]

Policy Number: [Policy Number]

Dear [Adjuster Name]:

This firm represents [Client Name] in connection with the motor vehicle collision that occurred on [Date of Accident] in [County] County, California. This letter constitutes our formal demand for settlement.

I. CALIFORNIA-SPECIFIC LEGAL FRAMEWORK

A. Statute of Limitations

Under California Code of Civil Procedure Section 335.1, the statute of limitations for personal injury claims arising from motor vehicle collisions is two (2) years from the date of the accident. This claim arises from an accident that occurred on [Date], and therefore the limitations period expires on [Expiration Date].

B. Pure Comparative Negligence

California follows the doctrine of pure comparative negligence established in Li v. Yellow Cab Co. (1975) 13 Cal.3d 804. Under this doctrine, a plaintiff's recovery is reduced by their percentage of fault, but recovery is not barred regardless of the degree of fault.

Our client bears no responsibility for this collision.

C. California Civil Code Section 3333.4 (Proposition 213)

[If applicable:] Please note that California Civil Code Section 3333.4 (Proposition 213) may affect the recovery of non-economic damages if an uninsured motorist is at fault. Our client [was properly insured / this section does not apply because your insured was at fault].

D. Insurance Requirements

California Vehicle Code Section 16056 requires minimum liability coverage of $15,000/$30,000 bodily injury and $5,000 property damage. Please confirm your insured's policy limits.

II. PRESERVATION OF EVIDENCE - SPOLIATION WARNING

YOU ARE HEREBY DIRECTED TO PRESERVE ALL EVIDENCE, including:

☐ The insured vehicle and all components

☐ Event Data Recorder (EDR) / "Black Box" data

☐ Photographs, repair estimates, and all documentation

☐ Complete claims file including adjuster notes

☐ Recorded statements

☐ Cell phone records (if distracted driving suspected)

☐ All surveillance footage

California recognizes independent tort claims for intentional spoliation of evidence. Cedars-Sinai Med. Ctr. v. Superior Court (1998) 18 Cal.4th 1. Destruction of evidence may result in sanctions and adverse inferences.

III. STATEMENT OF FACTS

A. The Collision

On [Date of Accident], at approximately [Time], our client was operating [his/her] [Year, Make, Model] vehicle [describe location and direction of travel] in [City], [County] County, California.

At that time, your insured, [At-Fault Driver Name], was operating a [Year, Make, Model] and [describe negligent conduct - be specific: "failed to stop at a red light," "was traveling at approximately [X] mph in a [Y] mph zone," "was looking at a cellular telephone," etc.].

[Detailed description of collision, including point of impact, forces involved, vehicle damage, etc.]

B. Police Investigation

The [California Highway Patrol / City Police Department / Sheriff's Department] responded to the scene and prepared Traffic Collision Report No. [Number]. The investigating officer determined that [describe findings].

[If citation issued:] Your insured was cited for violation of California Vehicle Code Section [Number] ([Description of violation]).

C. Scene and Conditions

- Location: [Exact location with cross-streets]

- Weather: [Conditions]

- Road: [Condition, type]

- Lighting: [Daylight/dark/artificial]

- Traffic: [Light/moderate/heavy]

IV. LIABILITY ANALYSIS

A. Negligence Elements

Under California law, a negligence claim requires proof of: (1) a legal duty of care; (2) breach of that duty; (3) causation; and (4) damages. Ladd v. County of San Mateo (1996) 12 Cal.4th 913, 917.

1. Duty: All motorists owe a duty of care to operate their vehicles safely. Cal. Veh. Code Section 21700.

2. Breach: Your insured breached this duty by:

☐ [Specific breach - e.g., "Running a red light in violation of Cal. Veh. Code Section 21453"]

☐ [Specific breach - e.g., "Failing to maintain a safe following distance in violation of Cal. Veh. Code Section 21703"]

☐ [Specific breach - e.g., "Operating a vehicle while using a handheld device in violation of Cal. Veh. Code Section 23123"]

☐ [Additional breaches]

3. Causation: Your insured's breach was the actual and proximate cause of the collision and our client's injuries.

4. Damages: Our client has suffered substantial damages as detailed below.

B. Negligence Per Se

[If citation issued:]

Your insured's violation of California Vehicle Code Section [Number] constitutes negligence per se under California law. Evid. Code Section 669. The statute was designed to protect motorists like our client, and its violation establishes breach of duty as a matter of law.

C. Comparative Fault Analysis

Our client exercised reasonable care at all times and bears no responsibility for this collision:

☐ Operating at a safe speed

☐ Maintaining a proper lookout

☐ Obeying all traffic laws

☐ [Other evidence of due care]

V. INJURIES AND MEDICAL TREATMENT

A. Summary of Injuries

As a direct and proximate result of this collision, our client sustained the following injuries:

☐ [Injury 1 with ICD-10 code if available]

☐ [Injury 2]

☐ [Injury 3]

B. Treatment Chronology

Emergency Care - [Date]:

- Provider: [Hospital/ER Name]

- Treatment: [Description]

- Findings: [Diagnosis, imaging results]

Follow-Up Care:

- Provider: [Name]

- Dates: [Range]

- Treatment: [Description]

Specialist Care:

- Provider: [Name, Specialty]

- Dates: [Range]

- Treatment: [Description]

Physical Therapy/Rehabilitation:

- Provider: [Name]

- Duration: [Sessions/weeks]

- Treatment: [Description]

C. Prognosis

[Describe current condition, MMI status, any permanent impairment, future treatment needs]

VI. DAMAGES

A. Medical Expenses

| Provider | Service Dates | Amount Billed |

|---|---|---|

| [Ambulance] | [Date] | $[Amount] |

| [Hospital ER] | [Date] | $[Amount] |

| [Primary Care] | [Dates] | $[Amount] |

| [Specialist] | [Dates] | $[Amount] |

| [Physical Therapy] | [Dates] | $[Amount] |

| [Diagnostic Imaging] | [Dates] | $[Amount] |

| [Pharmacy] | [Dates] | $[Amount] |

| TOTAL PAST MEDICAL | $[Total] |

Future Medical Expenses: $[Amount] (based on [treating physician opinion / life care plan])

B. Lost Wages and Earning Capacity

| Category | Amount |

|---|---|

| Past Lost Wages | $[Amount] |

| Lost Bonuses/Overtime | $[Amount] |

| Used PTO/Sick Leave | $[Amount] |

| Future Lost Earnings | $[Amount] |

| TOTAL LOST WAGES | $[Total] |

Supporting documentation from [Employer Name] attached.

C. Property Damage

| Category | Amount |

|---|---|

| Vehicle Repair/Total Loss | $[Amount] |

| Rental Car | $[Amount] |

| Personal Property | $[Amount] |

| TOTAL PROPERTY DAMAGE | $[Total] |

D. Pain and Suffering / Non-Economic Damages

Under California Civil Code Section 1431.2, our client is entitled to compensation for:

- Physical pain and suffering

- Emotional distress

- Inconvenience

- Loss of enjoyment of life

- [If applicable: Disfigurement, disability]

[Detailed narrative of client's pain and suffering]

E. Summary of Damages

| Category | Amount |

|---|---|

| Past Medical Expenses | $[Amount] |

| Future Medical Expenses | $[Amount] |

| Past Lost Wages | $[Amount] |

| Future Lost Earnings | $[Amount] |

| Property Damage | $[Amount] |

| TOTAL ECONOMIC DAMAGES | $[Subtotal] |

| Pain and Suffering | $[Amount] |

| TOTAL NON-ECONOMIC DAMAGES | $[Subtotal] |

| TOTAL DAMAGES | $[Grand Total] |

VII. SETTLEMENT DEMAND

Based upon the clear liability of your insured, the severity of our client's injuries, and the substantial damages incurred, we hereby demand:

$[DEMAND AMOUNT]

[OR for policy limits demands:]

TENDER OF FULL POLICY LIMITS OF $[AMOUNT]

This is a time-limited demand pursuant to California law regarding insurer bad faith. Comunale v. Traders & General Ins. Co. (1958) 50 Cal.2d 654.

This demand will remain open for thirty (30) days from the date of this letter, expiring at 5:00 p.m. Pacific Time on [Expiration Date].

Bad Faith Warning

Our client's damages clearly [approach / exceed] available policy limits. Under California law, your company has a duty to accept reasonable settlement demands within policy limits. Crisci v. Security Ins. Co. (1967) 66 Cal.2d 425. Failure to do so may expose your company to bad faith liability for the full amount of any excess judgment.

We strongly encourage you to advise your insured of this demand and the potential personal exposure.

VIII. RESPONSE INSTRUCTIONS

Please direct your response to the undersigned at the address above. Any settlement check should be made payable to "[Client Name] and [Firm Name], Client Trust Account" and forwarded to our office.

If we cannot resolve this matter, we are prepared to file suit immediately in the Superior Court of California, County of [County], and to pursue this matter through trial.

IX. DOCUMENTATION ENCLOSED

☐ Complete medical records and bills from all treating providers

☐ California Highway Patrol / Police Traffic Collision Report

☐ Photographs of vehicle damage

☐ Photographs of injuries

☐ Employment verification and lost wage documentation

☐ Property damage estimate/repair invoice

☐ Medical payment ledger

☐ HIPAA authorizations

X. CONCLUSION

The liability in this matter is clear and indisputable. Your insured caused this collision through [his/her] negligent operation of a motor vehicle. Our client has suffered significant injuries and substantial damages as a result.

This demand represents a fair evaluation of the case and an opportunity to resolve this matter without the time and expense of litigation. I urge you to give it serious consideration and respond promptly.

Thank you for your attention to this matter.

Respectfully submitted,

[FIRM NAME]

By: _________________________________

[Attorney Name]

State Bar of California No. [Number]

Attorney for [Client Name]

ENCLOSURES: As noted above

cc: [Client Name] (via email)

File

CALIFORNIA-SPECIFIC PRACTICE NOTES

☐ Pure Comparative Negligence: California allows recovery even if plaintiff is more at fault than defendant - only reduced by percentage of fault.

☐ Prop 213 (Civ. Code Section 3333.4): Uninsured motorists cannot recover non-economic damages unless defendant was DUI, committed a felony, or defendant was uninsured.

☐ CCP Section 998 Offers: Important cost-shifting mechanism - consider timing of formal offer to compromise.

☐ Prejudgment Interest: Civil Code Section 3291 - Available from date of filing if certain conditions met.

☐ Med Pay Subrogation: California prohibits health insurers from subrogating against third-party tort recoveries unless contractually agreed. Sapiano v. Williamsburg Nat'l Ins. Co. (1994) 28 Cal.App.4th 533.

☐ Punitive Damages: Available for "oppression, fraud, or malice" (e.g., DUI cases). Civ. Code Section 3294.

☐ Government Claims: If government entity involved, must file Government Tort Claim within 6 months (injury) or 1 year (property). Gov. Code Section 911.2.

☐ Bad Faith: California is plaintiff-friendly on insurer bad faith. Time-limited demands can create significant exposure for insurers.

☐ Venue: County where injury occurred or where defendants reside. CCP Section 395.

Do more with Ezel

This free template is just the beginning. See how Ezel helps legal teams draft, research, and collaborate faster.

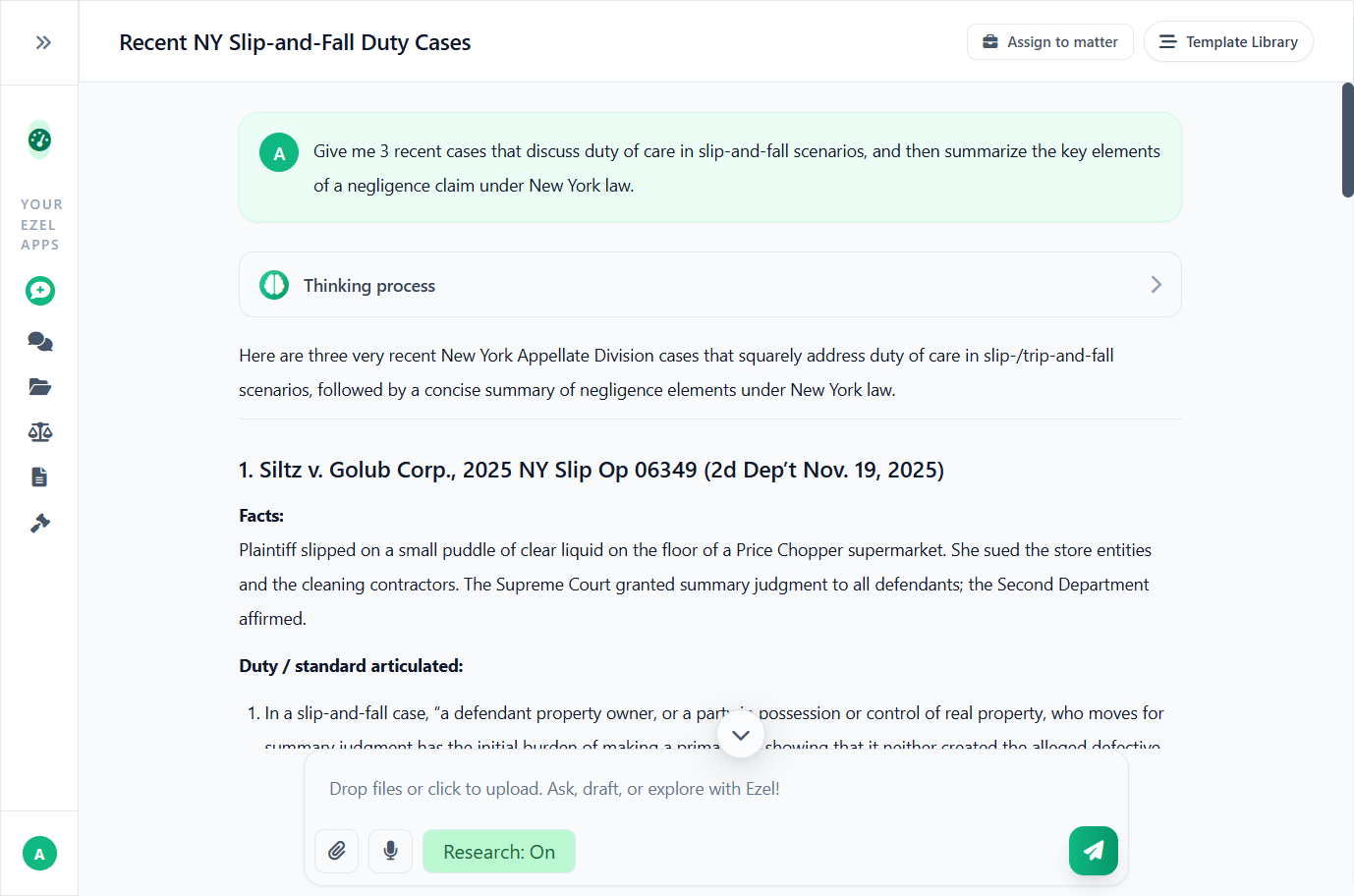

AI that drafts while you watch

Tell the AI what you need and watch your document transform in real-time. No more copy-pasting between tools or manually formatting changes.

- Natural language commands: "Add a force majeure clause"

- Context-aware suggestions based on document type

- Real-time streaming shows edits as they happen

- Milestone tracking and version comparison

Research and draft in one conversation

Ask questions, attach documents, and get answers grounded in case law. Link chats to matters so the AI remembers your context.

- Pull statutes, case law, and secondary sources

- Attach and analyze contracts mid-conversation

- Link chats to matters for automatic context

- Your data never trains AI models

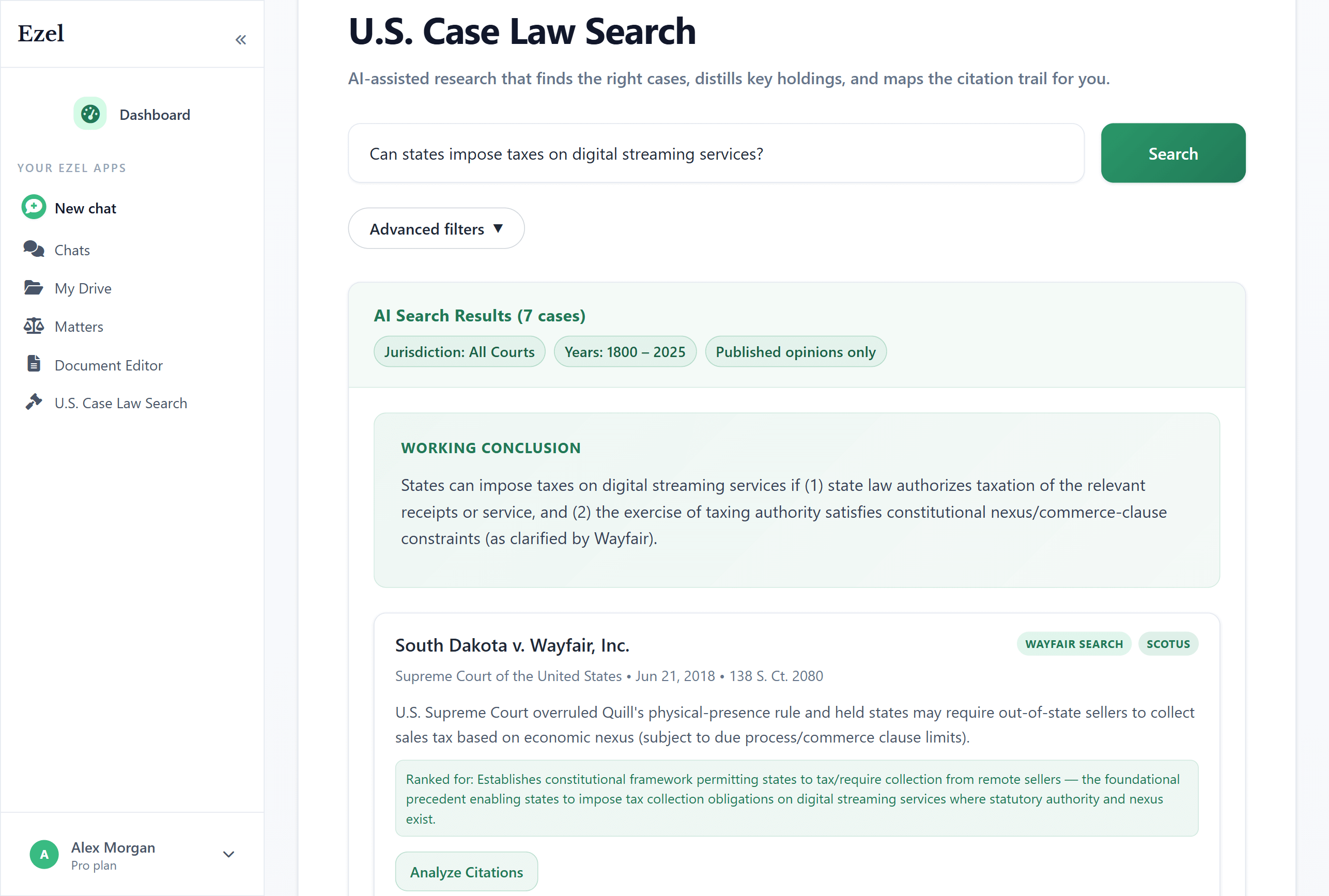

Search like you think

Describe your legal question in plain English. Filter by jurisdiction, date, and court level. Read full opinions without leaving Ezel.

- All 50 states plus federal courts

- Natural language queries - no boolean syntax

- Citation analysis and network exploration

- Copy quotes with automatic citation generation

Ready to transform your legal workflow?

Join legal teams using Ezel to draft documents, research case law, and organize matters — all in one workspace.